In "Eight Money Secrets Every Teacher Should Know," you'll discover a wealth of insights that can help improve your financial situation. From receiving free stocks through the Robinhood investment app to saving on car insurance by switching companies, this article provides easy-to-follow tips that can make a significant difference. Additionally, you'll learn about term life insurance policies that provide financial security for your loved ones, how to pay off credit card debt with low-interest loans through Fiona, and the benefits of refinancing car loans with Upstart. For teachers interested in real estate investment, Yieldstreet offers a platform to get started, while LoanDepot specializes in mortgage refinancing to potentially lower monthly payments. Whether you're looking to grow your savings or secure a more stable future, these money secrets are an essential read for educators.

This image is property of images.unsplash.com.

Stocks and Investments

Investing in stocks and other investments can be a great way to build wealth and secure your financial future. As a teacher, you may think that investing is only for those with a lot of money or extensive knowledge in the field. However, there are options available that make it easy and accessible for everyone, including educators like yourself.

One such option is Robinhood, an investment app that offers free stocks to its users. Yes, you read that right - free stocks. Robinhood allows you to invest in stocks, options, ETFs, and even cryptocurrencies without paying any fees. This means that you can start building your investment portfolio without worrying about expensive commissions eating into your profits.

By taking advantage of this offer, you can begin your investment journey and take steps towards growing your wealth. Whether you're interested in technology stocks, healthcare companies, or even just looking to diversify your portfolio, Robinhood provides a user-friendly platform to start investing in a way that suits your preferences and financial goals.

Investing in Real Estate with Yieldstreet

Real estate has long been considered a stable and lucrative investment. However, as a teacher, you may not have the time or resources to directly invest in properties. That's where Yieldstreet comes in.

Yieldstreet is an online platform that allows investors to gain access to real estate investment opportunities. They offer a variety of real estate investment options, including commercial real estate, single-family homes, and even luxury properties. As an investor on Yieldstreet, you can choose the types of real estate projects that align with your financial goals and risk tolerance.

Investing in real estate through Yieldstreet has several advantages. Firstly, it allows you to diversify your investment portfolio beyond traditional stocks and bonds. Real estate investments tend to be less volatile than the stock market, providing stability to your overall investment strategy.

Secondly, Yieldstreet does all the heavy lifting for you. They conduct thorough due diligence on each investment opportunity, ensuring that you have access to high-quality real estate projects. This means that you can invest with confidence, knowing that your money is being put towards professionally managed properties.

Insurance

Insurance is an important aspect of financial planning and can provide much-needed protection and peace of mind for you and your family. As a teacher, you may have unique insurance needs, and finding affordable coverage is essential to your overall financial security.

Saving on Car Insurance by Switching Companies

Car insurance is a necessary expense for most people, but it doesn't have to break the bank. As a teacher, you likely have a busy schedule and don't have the time to shop around for better rates. However, switching car insurance companies can often result in significant savings.

Many insurance companies offer discounts specifically for educators. By taking advantage of these discounts and comparing quotes from multiple providers, you can find a policy that offers the coverage you need at a price you can afford. Additionally, some companies offer discounts for safe driving records or for bundling your car insurance with other policies such as home or renters insurance.

Switching car insurance companies may seem like a hassle, but the potential savings can make it well worth your time. By spending a few minutes comparing rates and exploring different options, you could find yourself with extra money in your pocket each month.

Financial Security with Term Life Insurance

Ensuring the financial security of your family is a top priority, especially as a teacher. Term life insurance is a popular option for providing financial protection for your loved ones in the event of your passing.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. As a teacher, you can choose a policy term that aligns with your financial goals, such as until your children graduate college or your mortgage is paid off.

Term life insurance policies offer a death benefit to your beneficiaries if you were to pass away during the coverage term. This benefit can provide financial support to your family, helping to cover expenses such as funeral costs, mortgage payments, or your children's education.

The cost of term life insurance is generally more affordable than permanent life insurance options, making it an attractive choice for teachers on a budget. By comparing quotes from different insurance providers, you can find a policy that meets your needs and offers coverage at a price you can comfortably afford.

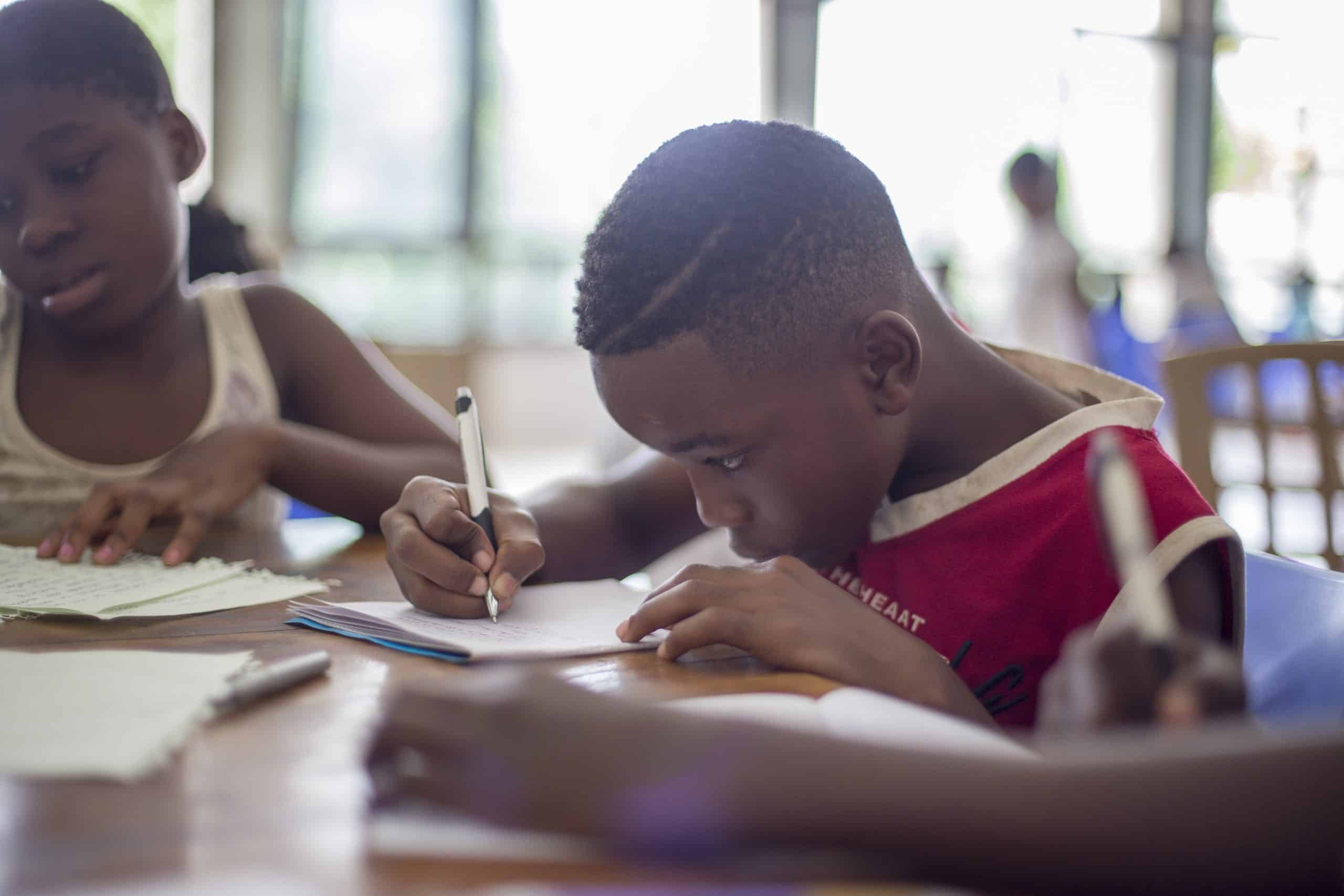

This image is property of images.unsplash.com.

Debt Management

Managing debt is an essential aspect of financial well-being. As a teacher, you may have accumulated credit card debt or other types of loans that can feel overwhelming. However, there are resources available to help you regain control of your financial situation.

Paying off Credit Card Debt with Fiona

Credit card debt can quickly become a burden, especially if you're dealing with high-interest rates and multiple cards. Fiona is an online platform that helps teachers and other borrowers find low-interest loans to consolidate their credit card debt into one manageable payment.

By utilizing Fiona's loan matching service, you can compare offers from multiple lenders and choose the one that best suits your needs. These loans often come with lower interest rates than credit cards, allowing you to save money on interest and pay off your debt more efficiently.

Consolidating your credit card debt into a single loan can simplify your financial life and help you get out of debt faster. With Fiona's user-friendly platform and personalized loan recommendations, you can take control of your financial future and work towards becoming debt-free.

Low-Interest Loans for Teachers

In addition to credit card debt, you may have other financial obligations that require additional funds. Whether it's home repairs, education expenses, or unexpected medical bills, finding affordable loans can be challenging.

Fortunately, there are loan programs specifically designed for teachers that offer low-interest rates and favorable terms. These loans can provide you with the additional funds you need while ensuring that you're not burdened with high-interest payments.

By exploring options tailored for educators, you can find loans that take into account your unique profession and financial circumstances. These loans may offer flexible repayment options, deferred payments during summer breaks, or forgiveness provisions for certain public service roles.

Taking advantage of low-interest loans for teachers can help you manage your finances more effectively and reduce your overall debt burden. It's always recommended to compare offers from different lenders to ensure you're getting the best possible terms and rates.

This image is property of images.unsplash.com.

Mortgages

Purchasing a home is an important milestone for many individuals, and as a teacher, you may be considering homeownership or looking to refinance your existing mortgage. Finding a suitable mortgage and saving money on monthly payments can make a significant difference in your overall financial picture.

Refinancing Mortgages with LoanDepot

Refinancing your mortgage can provide various benefits, such as obtaining a lower interest rate, reducing your monthly payments, or even shortening the term of your loan. LoanDepot is a company that specializes in helping teachers refinance their mortgages and potentially save money on their monthly payments.

LoanDepot offers a streamlined application process and personalized loan options tailored to educators. They understand the unique financial circumstances of teachers and aim to provide competitive rates and flexible terms.

By refinancing your mortgage with LoanDepot, you can potentially lower your interest rate, decrease your monthly payments, and save money over the life of your loan. These savings can free up funds that can be used towards other financial goals, such as saving for retirement or investing in your children's education.

Exploring refinancing options with LoanDepot is a smart financial move for teachers looking to save money and optimize their mortgage terms.

Car Loans

Car loans can be a significant financial obligation, especially if you're dealing with high interest rates or unfavorable terms. As a teacher, you may be looking for ways to reduce your monthly car payments and save money in the long run.

Saving Money on Monthly Car Payments with Upstart

Upstart is an online lending platform that specializes in helping individuals save money on their monthly car payments through refinancing. By refinancing your car loan through Upstart, you may be able to secure a lower interest rate and potentially reduce your monthly payments.

By taking advantage of Upstart's streamlined process and competitive rates, you can save money over the life of your car loan. This can provide additional financial flexibility and allow you to allocate those savings towards other financial goals.

As a teacher, finding ways to save money and optimize your monthly budget is crucial. By exploring refinancing options with Upstart, you can reduce your car loan expenses and pave the way towards a more secure financial future.

In conclusion, as a teacher, you have unique financial needs and challenges. However, there are resources available that can help you navigate various aspects of your financial journey, including investing, insurance, debt management, mortgages, and car loans. By taking advantage of these options, you can optimize your finances and work towards your long-term goals. Remember, it's never too early or too late to educate yourself and make informed decisions about your money. Start taking control of your financial future today!