If you're looking for an effective way to take control of your spending and stick to a budget, the cash envelope system could be the solution you've been searching for. This visual budgeting tool involves dividing your cash into different envelopes based on specific budget categories. By physically handing over cash for your purchases, you become more aware of how much you're spending and are less likely to overspend. Whether you want to track your expenses or simply have a visual representation of where your money is going, the cash envelope system is a useful strategy that can help you achieve your financial goals.

Understanding the Cash Envelope System

The cash envelope system is a visual budgeting tool that involves placing cash into different envelopes based on budget categories. It is a simple and effective method for managing your finances and controlling your spending. This system is ideal for anyone who wants to see exactly where their money is going and needs help sticking to a budget.

What is the cash envelope system?

The cash envelope system is a budgeting method that helps control spending and may lead to spending less money. By using cash instead of cards for your purchases, you can physically see and feel the money leaving your hands. This creates a greater awareness of your spending habits and encourages more mindful choices. With the cash envelope system, you divide your budgeted amount into various envelopes for different categories, such as groceries, entertainment, or transportation.

How does it work?

To use the cash envelope system, you first need to create a budget. Determine how much money you have available to allocate towards different expenses. Be realistic and consider your income, fixed expenses, and savings goals. Once you have an overall picture of your budget, you can determine how much cash to place in each envelope based on your spending goals.

Fixed expenses like mortgage or car payments are not included in the cash envelope budget, as they are typically paid electronically or through checks. The cash envelope system focuses on variable expenses that can be paid in cash, such as groceries, dining out, or entertainment.

Who can benefit from using this system?

Anyone who struggles with overspending or wants to have better control over their finances can benefit from using the cash envelope system. It is especially helpful for individuals who prefer visual aids and hands-on methods of budgeting. This system provides a tangible representation of your financial situation and helps keep you accountable for your spending.

Getting Started with the Cash Envelope System

Getting started with the cash envelope system requires a few initial steps to set yourself up for success.

Creating a budget

The first step is to create a comprehensive budget. Review your income, fixed expenses, and savings goals. Determine how much money you have available for variable expenses, which will be divided into your cash envelopes. Remember to allocate enough for each category to cover your anticipated spending.

This image is property of images.pexels.com.

Determining spending goals

Once you have your budget in place, it's important to determine your spending goals for each category. Understand what you can realistically afford to spend on groceries, entertainment, dining out, and other variable expenses. Consider your financial goals, such as saving for a vacation or paying off debt, and factor those into your spending goals as well.

Choosing budget categories

Decide on the specific budget categories that are important to you and align with your spending habits. Common categories include groceries, transportation, dining out, entertainment, clothing, and personal care. Tailor your budget categories to fit your lifestyle and spending priorities.

Calculating the cash amounts for each category

Based on your budget, calculate the cash amounts to place in each envelope for every budget category. Be mindful of your spending goals and ensure you have enough cash to cover your anticipated expenses. It's important to be realistic and allocate funds accordingly, without overspending or underestimating your needs.

Setting Up Your Cash Envelopes

Setting up your cash envelopes is a crucial step to ensure the effectiveness of the cash envelope system.

Gathering necessary materials

To set up your cash envelopes, you will need a few essential materials. Gather envelopes of various sizes, depending on your budget categories. Use colored envelopes or labels to differentiate between different categories easily. You may also want to have a small, portable wallet or pouch to keep your envelopes organized and secure.

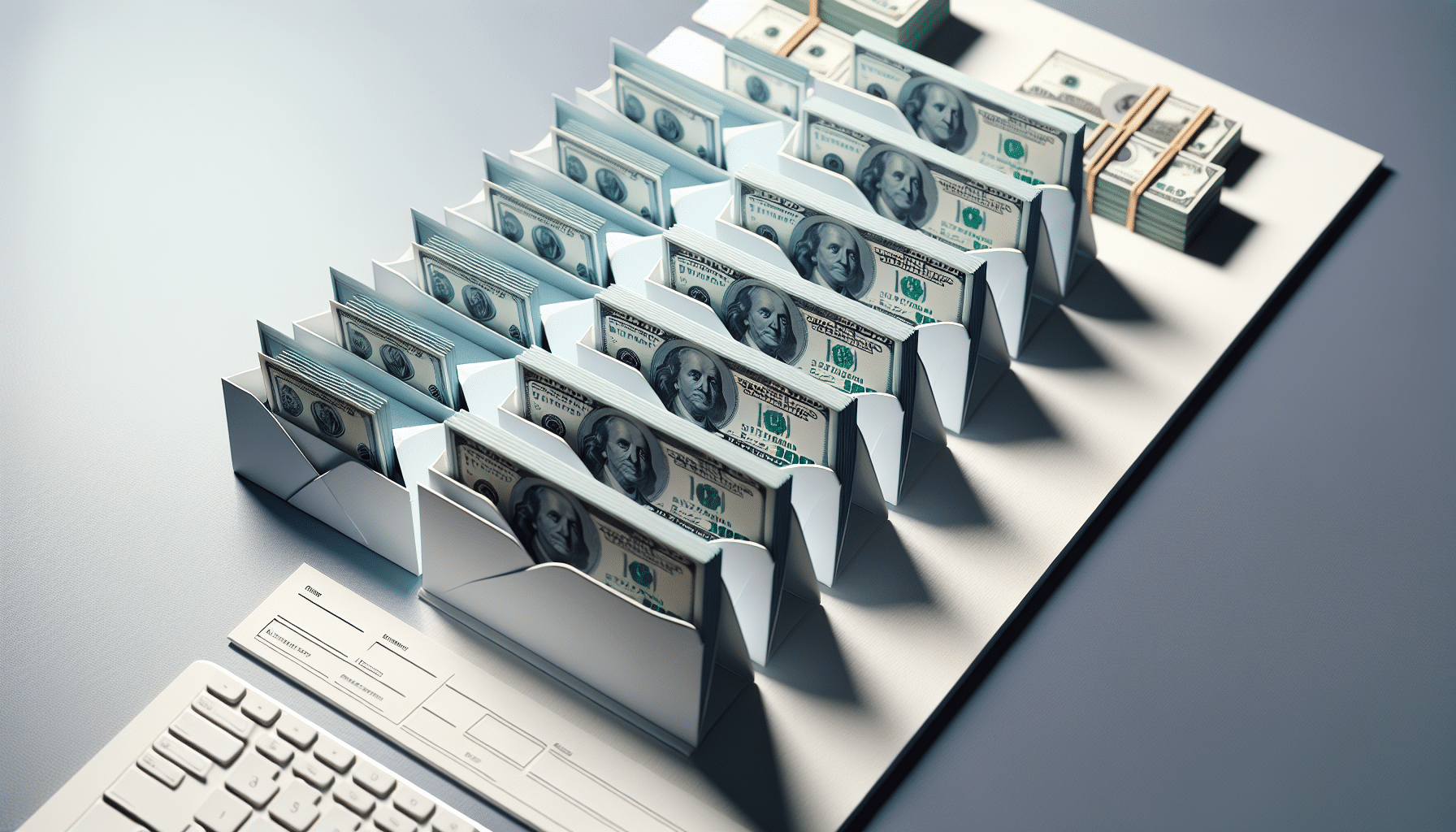

This image is property of images.pexels.com.

Labeling envelopes

Once you have your envelopes ready, label each one with the corresponding budget category. Use clear and concise labels that are easy to read. This will help you quickly identify the purpose of each envelope when making purchases or tracking your spending.

Assigning specific categories to each envelope

Assign specific budget categories to each envelope based on your spending goals. Consider the categories you established in your budget and ensure you have an envelope for each one. For example, if you allocated $200 for groceries in your budget, you should have a dedicated envelope labeled "Groceries" with $200 cash inside.

Excluding Fixed Expenses

It's important to understand the distinction between fixed expenses and variable expenses when implementing the cash envelope system.

Understanding fixed expenses

Fixed expenses are recurring costs that remain the same each month. These typically include mortgage or rent payments, car payments, insurance premiums, and utility bills. These expenses are usually paid electronically or through checks and are not included in the cash envelope system.

Separating fixed expenses from variable expenses

To effectively use the cash envelope system, it's essential to separate your fixed expenses from your variable expenses. Allocate the necessary funds for fixed expenses separately and ensure they are paid promptly. This will prevent any confusion or overlap between your different financial obligations and allow you to focus on managing your variable expenses through the cash envelope system.

Using the Cash Envelope System in Practice

Using the cash envelope system involves a few practical steps to make the most of this budgeting method.

This image is property of images.pexels.com.

Withdrawing cash for your budget

Once you have determined the cash amounts for each budget category, withdraw the necessary funds from your bank account. Visit your preferred ATM or bank branch and withdraw the total amount needed to fill your envelopes. Make sure to handle the cash responsibly and securely.

Placing designated amounts into each envelope

Take the cash you withdrew and distribute it into the appropriate envelopes based on your spending goals. Place the designated amounts into each envelope, ensuring you have enough cash to cover your anticipated expenses. This allocation provides a clear visual representation of how much money you have available to spend in each category.

Carrying the envelopes when going out

When you leave your home and anticipate making purchases, make sure to take the relevant envelopes with you. Carry the envelopes for the categories you're likely to spend on during your outing. This helps you stay within your budget and avoid overspending.

Using cash for your purchases

When making a purchase, use the cash from the corresponding envelope for that category. Handing over physical cash reinforces the awareness of your spending and encourages conscious decision-making. By relying on cash instead of cards, you can fully understand the impact of each purchase on your budget.

Benefits of the Cash Envelope System

Implementing the cash envelope system offers several benefits that can contribute to improved financial management and healthier spending habits.

Increased awareness of spending

The cash envelope system provides a tangible and visual representation of your spending. By physically seeing and feeling the cash leave your hands, you become more aware of the value of money and the impact of your purchases. This increased awareness can help curb impulse buying and encourage more mindful spending habits.

Better control over finances

With the cash envelope system, you have a clear allocation of funds for each category. This allows you to exercise better control over your finances and avoid overspending. When the cash runs out in a particular envelope, it signals that you have reached your spending limit for that category. This control helps you stay on track with your budget and ultimately make progress towards your financial goals.

Reduced impulse buying

One of the key benefits of the cash envelope system is its ability to reduce impulse buying. By relying on physical cash instead of cards, you are less likely to make impulsive purchases. The act of physically handing over money for each transaction adds an extra layer of consideration and reduces the temptation to spend unnecessarily.

Accurate tracking of expenses

Using cash envelopes makes it easier to track your expenses and ensure they align with your budget. With each transaction, you can see how much money is left in the envelope and how much you have spent so far. This real-time tracking provides a clear picture of your spending habits and allows you to make adjustments as needed.

Challenges and Tips for Success

While the cash envelope system can be an effective budgeting strategy, it does come with its own set of challenges. Here are some common obstacles and tips for success.

Adjusting your budget as needed

Your budget is not set in stone, and it's important to be flexible and adjust as needed. Life circumstances and unexpected expenses may require you to reallocate funds from one category to another. Stay proactive and make adjustments as necessary to ensure your budget remains realistic and sustainable.

Dealing with unexpected expenses

It's inevitable that unexpected expenses will arise from time to time. When faced with an unexpected cost, try to find ways to adjust your budget or find savings in other areas. If necessary, consider using funds from your emergency savings rather than borrowing from other envelopes. Handling unexpected expenses while maintaining the integrity of your budget will help you stay on track in the long run.

Managing large purchases

Large purchases can be challenging to manage within the cash envelope system. In these cases, plan ahead and start saving money in a separate envelope specifically for that purchase. This way, you can accumulate the necessary funds over time and make the purchase when you have saved enough. Keep the envelope for the large purchase separate from your other categories to avoid confusion.

Avoiding the temptation to borrow from other envelopes

It's important to resist the temptation to borrow from other envelopes when a particular category runs out of cash. This defeats the purpose of the cash envelope system and can lead to overspending or mismanagement of your budget. Instead, consider adjusting your spending habits or finding alternative ways to meet your needs until the next budget cycle.

Tracking Your Spending with the Cash Envelope System

To make the most out of the cash envelope system, it's important to track your spending and ensure it aligns with your budget.

Choosing a method for recording expenses

There are various methods you can use to record your expenses. Choose a method that works best for you, whether it's a spreadsheet, an app, or a pen and paper. Find a system that allows you to easily track and categorize your expenses, making it simple to reconcile your budget with your actual spending.

Keeping receipts or maintaining a spending log

To ensure accurate tracking of your expenses, it's helpful to keep receipts or maintain a spending log. These records provide a detailed overview of your purchases and make it easier to categorize and reconcile your spending. Regularly update your spending log or review your receipts to stay on top of your budget.

Reconciling your budget with actual spending

At the end of each budget cycle, take some time to reconcile your budget with your actual spending. Compare your recorded expenses with the initial budget allocation and make adjustments or corrections as necessary. This process allows you to evaluate your spending habits, identify areas for improvement, and make necessary changes for the next budget cycle.

Making the Cash Envelope System a Habit

To maximize the benefits of the cash envelope system, it's important to make it a habit and integrate it into your daily routine.

Consistency is key

Consistency is crucial to successfully implementing the cash envelope system. Make it a habit to allocate your budgeted amounts to the appropriate envelopes regularly. Stick to your budget when making purchases and stay accountable to your financial goals. The more consistent you are, the more effective the system will be in helping you achieve financial stability.

Reviewing your budget regularly

Take time on a regular basis to review your budget and track your progress. Assess whether your spending aligns with your goals and make any necessary adjustments. Regular reviews allow you to stay on top of your finances and make informed decisions moving forward.

Celebrating your successes

Celebrate your successes and milestones along the way. Recognize and reward yourself for exceeding your goals or sticking to your budget. These celebrations can help reinforce positive financial habits and motivate you to continue on your financial journey.

Seeking support and accountability

If you find it challenging to stick to the cash envelope system on your own, consider seeking support and accountability. Share your budgeting journey with a trusted friend, partner, or family member who can help keep you accountable. Joining a financial support group or online community can also provide valuable guidance and encouragement.

When to Reevaluate or Stop Using the Cash Envelope System

While the cash envelope system can be a useful budgeting strategy, there may be circumstances when it needs reevaluation or alternative methods may be more suitable.

Life changes that may require adjustments

Life changes such as a job loss, a significant increase or decrease in income, or a major life event may require adjustments to your budgeting strategy. During these times, reevaluate your financial situation and determine whether the cash envelope system is still the best approach. Be open to exploring alternative budgeting methods that better suit your current circumstances.

Transitioning to alternative budgeting methods

As your financial situation evolves, you may find that alternative budgeting methods are more appropriate for your needs. If the cash envelope system is no longer effective or practical, consider transitioning to a digital budgeting tool, spreadsheets, or apps that can automate your budget tracking and provide more flexibility.

Assessing your long-term financial goals

Regularly assess your long-term financial goals and evaluate whether the cash envelope system is still aligned with those goals. As your priorities change and evolve, you may need to adjust your budgeting methods to better support your objectives. Continually assess the effectiveness of the cash envelope system in helping you achieve your financial goals and make informed decisions accordingly.

In conclusion, the cash envelope system is a powerful tool that can help you gain control over your finances and improve your spending habits. By creating a budget, organizing your cash envelopes, and sticking to your spending goals, you can achieve financial stability and work toward your long-term goals. Remember to track your expenses, adjust your budget as needed, and celebrate your successes along the way. Whether you use the cash envelope system for a short period or incorporate it as a long-term financial strategy, it can be a valuable tool in your journey toward financial well-being.