Imagine having all your hard-earned savings stored in a bank, only to find out that the bank has suddenly failed. The thought of losing everything can be incredibly daunting, especially if you have a substantial amount saved up. However, there is a solution that provides peace of mind and safeguards your money in case of such an unfortunate event: FDIC insurance. With FDIC insurance, you can protect your large savings and ensure that even if your bank fails, your money is secure. In this article, we will explore the importance of FDIC insurance and how it can provide financial protection for your savings.

Understanding FDIC Insurance

What is FDIC?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that was created in 1933 to provide stability and public confidence in the nation's banking system. The FDIC is responsible for insuring deposits in member banks and promoting the safety and soundness of these institutions.

What is FDIC Insurance?

FDIC insurance is a program that protects depositors against the loss of their deposits if an FDIC-insured bank were to fail. It ensures that depositors have access to their insured funds, up to the coverage limit, even in the event of a bank failure.

How does FDIC Insurance work?

When you deposit your money into an FDIC-insured bank, your funds are automatically covered by FDIC insurance, up to the standard coverage limit. In the unfortunate event of a bank failure, the FDIC steps in to provide reimbursement for the insured amount, typically within a few days. This ensures that depositors can access their funds without experiencing financial hardship due to a bank failure.

Coverage limits for FDIC Insurance

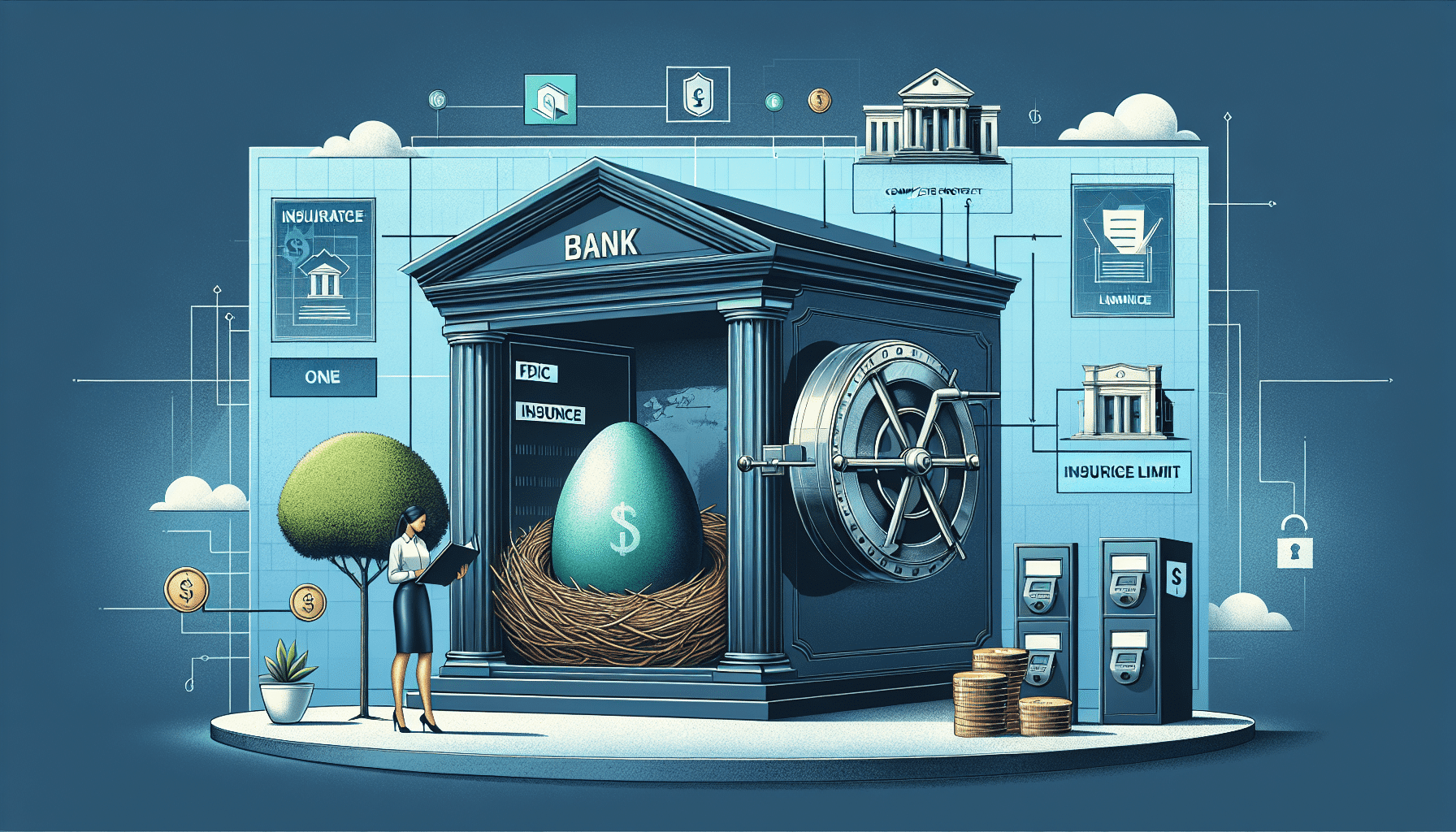

The standard coverage limit for FDIC insurance is $250,000 per depositor, per insured bank. This means that if you have multiple accounts in the same bank, the total amount of your deposits up to $250,000 will be insured. It's important to note that this coverage applies to each different ownership category, such as individual accounts, joint accounts, and retirement accounts. We will further explore these coverage limits in the following sections.

Importance of Protecting Large Savings

Why protecting large savings is crucial

For individuals with substantial savings, protecting those funds becomes incredibly important. Large savings are often accumulated over a lifetime through diligent saving and investment. Losing a significant portion of these savings due to a bank failure can have a profound impact on your financial well-being and future plans.

Risks associated with bank failure

While the likelihood of a bank failure is relatively low, it is not entirely impossible. Unforeseen circumstances, such as economic downturns or mismanagement, can lead to the downfall of financial institutions. In the event of a bank failure, depositors without FDIC insurance could face the loss of their entire savings.

Impact of bank failure on large savings

If a bank were to fail and you had uninsured deposits, you could potentially lose all of your savings beyond the FDIC-insured limit. This could mean a substantial setback in your financial goals, such as retirement planning or funding major life expenses. Protecting your large savings with FDIC insurance ensures that you have a safety net in case of unforeseen bank failures.

Eligibility for FDIC Insurance

Which banks are covered by FDIC Insurance?

FDIC insurance covers banks that are members of the FDIC. This includes most banks in the United States, including national banks, state-chartered banks, and savings associations. It's important to verify that the bank you are considering for your deposits is an FDIC member institution.

Types of deposit accounts covered

FDIC insurance covers various types of deposit accounts, including checking accounts, savings accounts, certificates of deposit (CDs), money market deposit accounts, and certain retirement accounts. These accounts must be held in an FDIC member bank to be eligible for insurance coverage.

Exceptions and exclusions

There are certain types of deposits that are not covered by FDIC insurance. These include investments in stocks, bonds, mutual funds, and annuities. Additionally, funds held in safe deposit boxes, even if they are located within an FDIC-insured bank, are not covered by FDIC insurance. It's essential to understand the specific coverage limitations to ensure the protection of your savings.

Determining FDIC Insurance Coverage

Calculation of coverage on deposit accounts

The FDIC insures up to $250,000 per depositor, per insured bank. This means that if you have multiple deposit accounts in the same bank, the total amount of your deposits up to $250,000 will be insured. To calculate your coverage on deposit accounts, you need to add up the balances in all your accounts within the same ownership category.

Joint accounts and coverage limits

For joint accounts, FDIC insurance coverage is calculated differently. The $250,000 coverage extends to each co-owner of the joint account. This means that if you have a joint account with another person, you each receive $250,000 in coverage, resulting in a total coverage of $500,000 for the joint account.

Coverage of retirement accounts

Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) accounts, are also eligible for FDIC insurance. The $250,000 coverage limit for retirement accounts applies separately from other types of deposit accounts. Therefore, if you have both a regular deposit account and a retirement account in the same bank, each account is insured up to $250,000.

Calculating insurance coverage for multiple account holders

When multiple individuals hold accounts jointly, the FDIC calculates coverage based on the proportionate interest of each co-owner. For example, if three individuals jointly hold a deposit account, and each holds a one-third interest, the FDIC would insure each individual's interest up to $250,000. It's crucial to carefully consider the ownership structure of your accounts to maximize the protection of your savings.

Steps to Protect Large Savings

Ensure deposits are with FDIC-insured banks

To protect your large savings, it is crucial to ensure that your deposits are held in FDIC-insured banks. Before opening an account, verify that the bank is a member of the FDIC by checking the FDIC's online database. This database provides the necessary information to determine if a bank is insured and the extent of its coverage.

Diversify deposits across multiple banks

Another important measure to protect your large savings is to diversify your deposits across multiple banks. By spreading your deposits among different FDIC-insured institutions, you can maximize the amount of FDIC insurance coverage you have. This reduces the risk of losing your entire savings in the event of a bank failure.

Consider different account types for increased coverage

Exploring different types of accounts can also help increase your FDIC insurance coverage. For example, if you have a substantial amount of savings, you might consider opening multiple individual accounts or retirement accounts. By doing so, you can take advantage of the $250,000 coverage limit for each account type.

Manage accounts within FDIC insurance limits

To ensure that your funds are fully protected, carefully manage your accounts within the FDIC insurance limits. Regularly check the balance in each account and monitor any changes that might impact your coverage. By keeping deposits within the coverage limits, you can have peace of mind knowing that your savings are fully protected.

Signs of Bank Troubles

Warning signs of bank instability

Monitoring the financial health of your bank is an essential step in protecting your large savings. Some warning signs of banking troubles include declining stock prices, negative news reports, rumors of financial difficulties, and changes in leadership or management. Staying informed and aware of any potential issues can help you take proactive measures to safeguard your savings.

Monitoring financial health of the bank

While it may not be possible to predict a bank failure with certainty, monitoring the financial health of your bank can provide valuable insights. Review the bank's financial statements, annual reports, and ratings from credit agencies. Additionally, staying informed about the overall economic conditions can help you assess the stability of your bank.

Being proactive in case of concerns

If you have concerns about the financial health of your bank, it's important to be proactive. Consider reaching out to your bank's customer service department to address any questions or concerns you may have. In some cases, it might be prudent to consider moving your deposits to a different FDIC-insured institution to ensure the safety of your savings.

FDIC Insurance and Investment Products

Insurance coverage for investment products

FDIC insurance strictly applies to deposit accounts, such as checking accounts, savings accounts, and CDs. Investment products, such as stocks, bonds, and mutual funds, are not covered by FDIC insurance. If you have substantial investments, it's important to understand the difference between deposit accounts and investment products in terms of insurance coverage.

Differentiating between deposit accounts and investment products

To determine if a particular product is covered by FDIC insurance, it's crucial to understand its nature. Deposit accounts are backed by the FDIC, while investment products carry their own associated risks. Profitability and potential losses associated with investment products are subject to market conditions and are not protected by FDIC insurance.

Understanding the risks and limitations

While FDIC insurance provides a safety net for your deposits, it's important to be aware of its limitations. The coverage limit of $250,000 per depositor, per insured bank means that any amount beyond this limit is not insured. It's advisable to assess the risks associated with exceeding the coverage limits and consider additional measures to protect your funds, such as diversifying your investments and seeking professional financial advice.

Handling Bank Failure

What happens when a bank fails?

In the event of a bank failure, the FDIC steps in to resolve the situation and protect the depositors' funds. The FDIC typically arranges for the transfer of the failed bank's deposits to another insured institution. This ensures that depositors can access their funds without significant interruption despite the bank failure.

FDIC's role in handling bank failures

The FDIC plays a crucial role in handling bank failures and protecting depositors. It has the authority to oversee the resolution of failing banks, sell assets of the failed institution, and distribute funds to insured depositors. The FDIC's primary goal is to maintain public confidence in the banking system and ensure that depositors are not left empty-handed.

Recovering funds after a bank failure

If your bank were to fail, the FDIC would make arrangements for you to recover your insured funds. This typically involves either transferring your deposits to a new insured institution or providing you with a check for your insured balance. The FDIC makes every effort to minimize any inconvenience and ensure that depositors can access their funds as quickly as possible.

FDIC Insurance Limitations

Coverage limitations beyond the standard limit

While the standard coverage limit for FDIC insurance is $250,000 per depositor, per insured bank, there are instances where coverage can exceed this limit. For example, if you have a revocable living trust account with multiple beneficiaries, each beneficiary can be insured separately up to $250,000. It's important to review the specific rules and limitations that apply to your unique circumstances to fully understand the extent of your coverage.

Impact of inflation on coverage

It's important to consider the potential impact of inflation on the value of FDIC coverage over time. While the coverage limit remains at $250,000, the purchasing power of that amount may decrease over the years due to inflation. This means that the real value of your insured deposits might decrease if the cost of goods and services rises significantly.

Assessing risks of exceeding coverage limits

If you have large savings that exceed the coverage limit, it's essential to assess the risks associated with exceeding the limit. In the event of a bank failure, any amount beyond the coverage limit would be uninsured and could potentially be lost. Consider diversifying your deposits across multiple banks and exploring additional measures, such as utilizing different ownership categories or account types, to mitigate the risks associated with exceeding the coverage limits.

Additional Measures to Protect Large Savings

Maintaining up-to-date account records

To ensure the accurate calculation of your FDIC insurance coverage, it's crucial to maintain up-to-date records of your accounts. Keep track of the balances in all your deposit accounts, including joint accounts and retirement accounts. Regularly review and update your account records to reflect any changes in your financial situation.

Reviewing insurance coverage periodically

As your financial circumstances evolve, it's important to review your FDIC insurance coverage periodically. Life events such as marriage, divorce, or inheritance can impact the ownership structure of your accounts and therefore change your coverage. By regularly assessing your coverage, you can ensure that your large savings remain fully protected.

Seeking professional financial advice

If you have significant savings and want to maximize your protection, consider seeking professional financial advice. A financial advisor can help you navigate the complexities of FDIC insurance and guide you in developing a comprehensive plan to safeguard your wealth. They can also provide insights into investment strategies and risk management techniques to further protect your savings.

In conclusion, protecting your large savings with FDIC insurance is crucial in mitigating the risks associated with bank failure. Understanding the fundamentals of FDIC insurance, eligibility requirements, coverage limits, and additional measures can help you safeguard your valuable savings. By taking proactive steps to ensure the safety of your deposits, you can have peace of mind knowing that your financial future is protected.