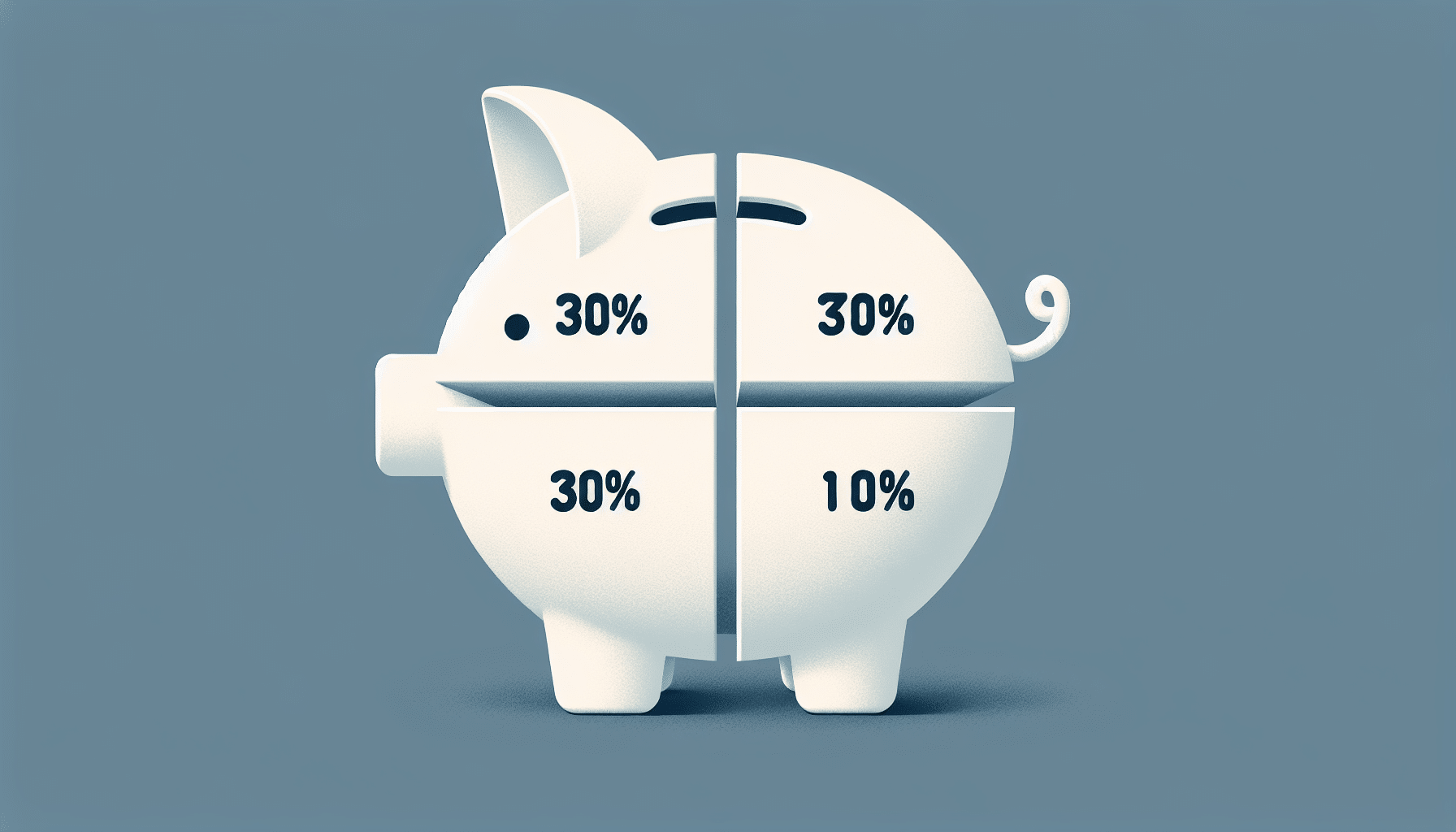

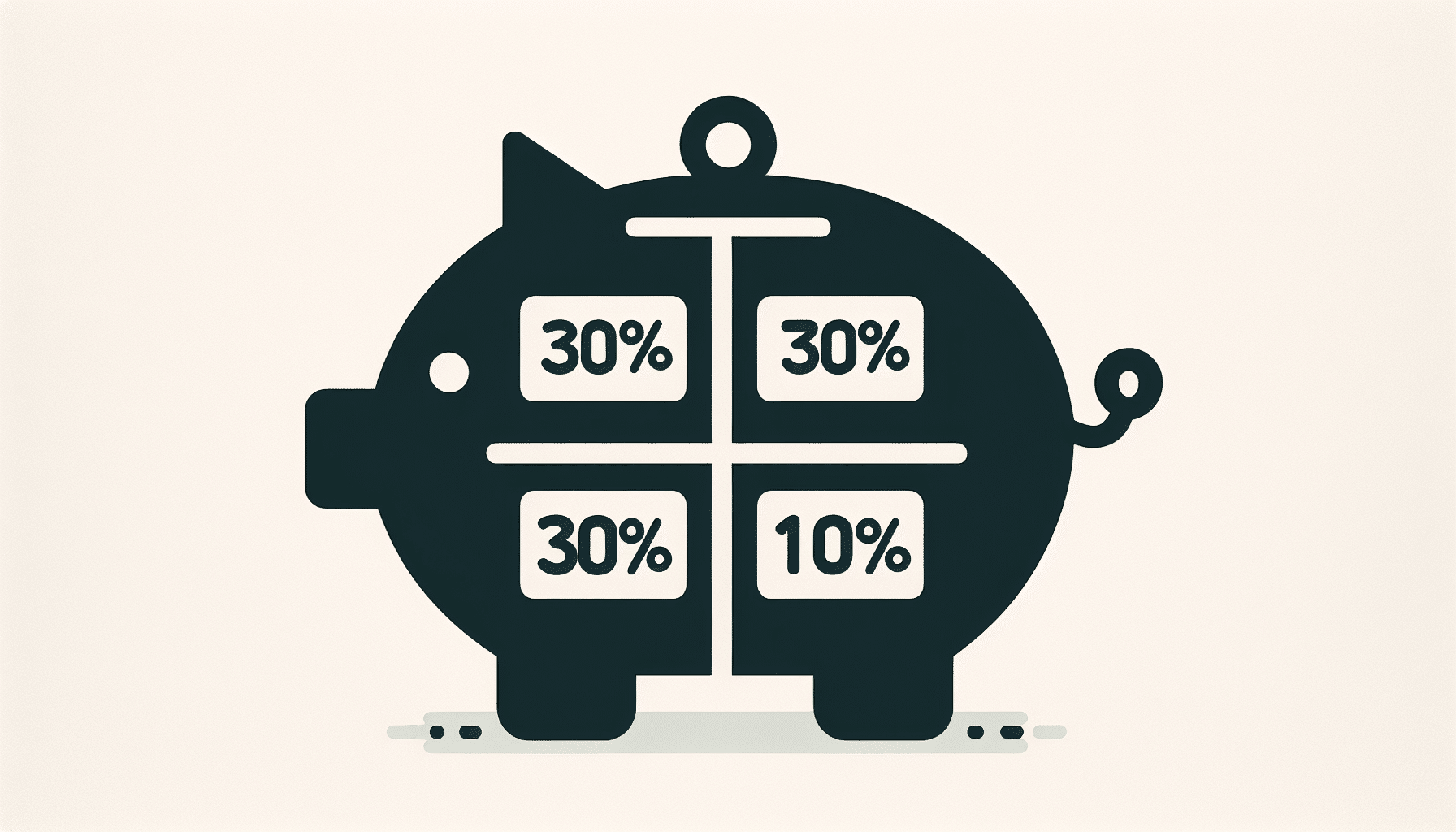

Are you looking for a structured and effective budgeting method? Look no further than the 30-30-30-10 budget - a percentage-based budgeting approach that can provide guidance and help you prioritize your financial goals. With this method, you allocate 30% of your income to housing, another 30% to other necessary expenses, dedicate 30% to your financial goals, and leave 10% for your wants. While this budgeting technique is great for individuals seeking a clear framework, it may not be the best fit for those living in high-cost areas or for those who prefer more flexibility in their spending. To get started with this budgeting strategy, calculate your income and expenses, divide them into categories, set specific financial goals, and adjust your spending to align with the percentages. And if the 30-30-30-10 doesn't suit your needs, you can always explore alternatives like the 50-30-20 budget or the 80-20 budget.

This image is property of pixabay.com.

Setting up a 30-30-30-10 budget

Setting up a budget is essential for managing your finances effectively. It helps you keep track of your income and expenses, and ensures that you are making progress towards your financial goals. One popular method of budgeting is the 30-30-30-10 budget, which allocates specific percentages to different spending categories. This method provides a clear structure that can guide your spending and help you prioritize your financial goals.

Calculate income and expenses

Before you can set up a 30-30-30-10 budget, you need to have a clear understanding of your income and expenses. Calculate your total monthly income, including any salaries, wages, or additional sources of revenue. This will give you a starting point to determine how much you can allocate to different budgeting categories.

Next, calculate your monthly expenses. This includes fixed expenses such as rent or mortgage payments, utility bills, and loan payments. It also includes variable expenses such as groceries, transportation costs, and entertainment. By having a thorough understanding of your income and expenses, you can make more informed decisions when dividing them into different categories.

Divide expenses into categories

The 30-30-30-10 budget divides your expenses into four main categories: housing, other necessary expenses, financial goals, and wants. Allocate 30% of your monthly income to housing expenses, which includes rent or mortgage payments, property taxes, and homeowners' insurance. This category ensures that you have a comfortable and stable living arrangement.

Next, allocate another 30% of your income to cover other necessary expenses. This includes utilities, groceries, transportation costs, healthcare expenses, and other essential needs. By setting aside a specific percentage for these expenses, you ensure that you have enough to cover your day-to-day living requirements.

Set specific financial goals

One of the key advantages of the 30-30-30-10 budget is that it allows you to prioritize your financial goals. By allocating 30% of your income to this category, you are setting yourself up for long-term financial success. Consider what your goals are – whether it's paying off debt, saving for retirement, or building an emergency fund – and allocate this portion of your income accordingly. This category provides the necessary structure and discipline to make progress on your financial objectives.

Adjust spending to fit the percentages

Once you have allocated percentages to the housing, other necessary expenses, and financial goals categories, the remaining 10% can be used for wants. This category includes discretionary spending on non-essential items such as dining out, entertainment, and personal indulgences. While it is important to have some flexibility in your budget, it is equally crucial to ensure that your wants do not overpower your financial responsibilities.

It may be necessary to adjust your spending habits to fit within the designated percentages. This could mean cutting back on certain discretionary expenses or finding ways to save on your necessary expenses. By staying disciplined and mindful of your budget, you can stay on track with your financial goals while still enjoying the occasional treat or splurge.

This image is property of pixabay.com.

Advantages of the 30-30-30-10 budget

The 30-30-30-10 budget offers several advantages that make it an appealing option for many individuals. Firstly, it provides structure and guidance in budgeting. By dividing your income into specific categories, you are better equipped to manage your finances and make intentional decisions about how you allocate your money. This structure gives you a clear plan to follow, which can help reduce stress and uncertainty about where your money is going.

Additionally, the 30-30-30-10 budget helps prioritize financial goals. By allocating a significant portion of your income to this category, you are making your long-term financial well-being a priority. This method ensures that you are consistently contributing to your savings, investments, or debt repayment, even if it means making sacrifices in other areas. Prioritizing financial goals is critical for achieving financial stability and future success.

This image is property of pixabay.com.

Considerations for the 30-30-30-10 budget

While the 30-30-30-10 budget can be effective for many individuals, there are some considerations to keep in mind before implementing this method. One consideration is that it may not work well in high-cost-of-living areas. If a significant portion of your income is already dedicated to housing expenses, it may be challenging to allocate only 30% to cover all other necessary expenses. In such cases, it may be necessary to adjust the percentages or explore alternative budgeting methods.

Another consideration is the limited flexibility in spending on wants. While having a designated percentage for discretionary spending is important, the 10% allocated in the 30-30-30-10 budget may not be sufficient for individuals who have high or diverse spending preferences. If you foresee needing more flexibility in your budget to accommodate your wants, it may be worth exploring alternative budgeting methods that allow for a higher allocation to discretionary expenses.

Exploring alternative percentage-based budgets

If the 30-30-30-10 budget does not align with your financial situation or spending preferences, there are alternative percentage-based budgets that you can consider. One such option is the 50-30-20 budget, which allocates 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment. This budget allows for a higher allocation towards discretionary spending, making it more suitable for individuals who desire more flexibility in their budget.

Another alternative is the 80-20 budget, which devotes 80% of your income to necessities and financial obligations, and 20% to wants and savings. This budget is useful for individuals who have limited discretionary spending and want to focus primarily on their financial responsibilities and goals.

When exploring alternative budgets, remember that the key is to find a system that aligns with your goals and lifestyle. It is essential to strike a balance between meeting your financial obligations and allowing for some flexibility and enjoyment. Ultimately, the goal of any budgeting method is to help you achieve financial stability and make progress towards your long-term objectives.