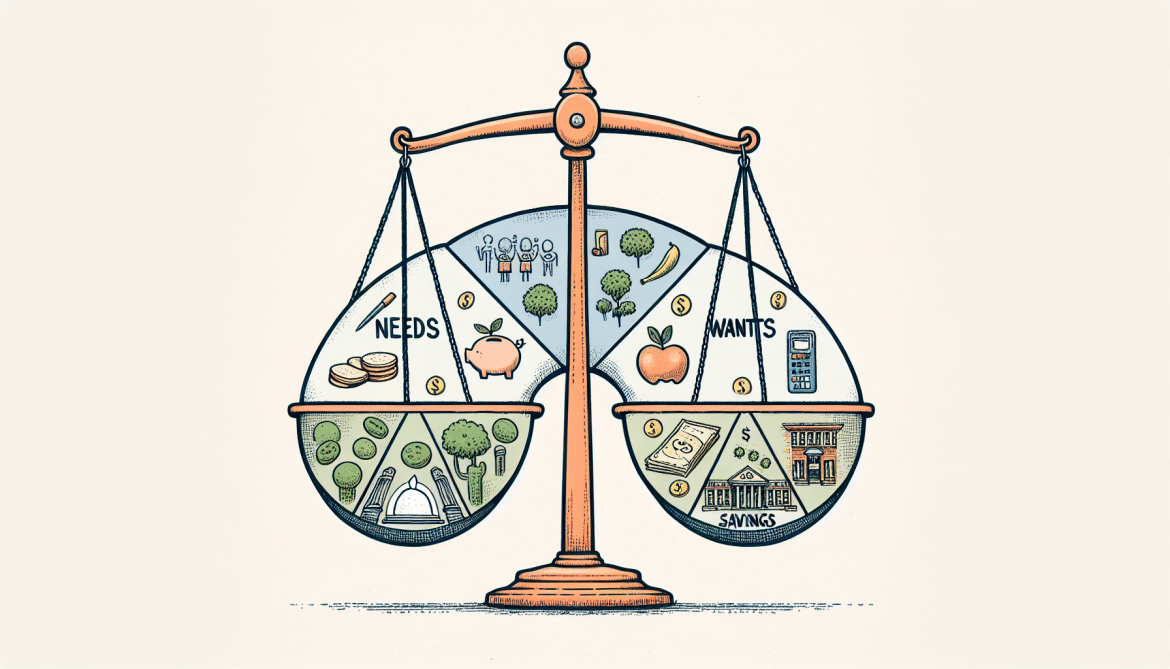

Imagine a budgeting approach that is simple, easy to implement, and helps you achieve financial balance. Enter the 50-30-20 budget rule: a game-changing method that divides your after-tax income into three categories. With 50% for needs, 30% for wants, and 20% for savings, this rule allows you to prioritize your monthly financial commitments while accounting for every dollar. Created by U.S. Senator Elizabeth Warren and outlined in her book "All Your Worth: The Ultimate Lifetime Money Plan," this rule not only keeps you on top of your finances but also helps you work towards your long-term financial goals. Whether you're looking to build an emergency fund, save for retirement, or invest, the 50-30-20 budget rule provides a balanced, effective solution.

Understanding the 50-30-20 Budget Rule

Budgeting is an essential skill for managing your personal finances. One popular method of budgeting is the 50-30-20 budget rule. This rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings. By following this rule, you can effectively allocate your income and work towards your financial goals. In this article, we will take a closer look at the 50-30-20 budget rule, its origins, benefits, and how to implement it in your own life.

This image is property of images.unsplash.com.

What is the 50-30-20 Budget Rule?

The 50-30-20 budget rule is a guideline that helps individuals allocate their income into three main categories: needs, wants, and savings. It was created by U.S. Senator Elizabeth Warren and is outlined in the book "All Your Worth: The Ultimate Lifetime Money Plan." This budget rule is designed to be simple and easy to implement, allowing you to prioritize your monthly financial commitments effectively.

Origins of the 50-30-20 Budget Rule

The 50-30-20 budget rule was developed by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, as a way to help individuals achieve financial stability. Through their research and experience, they found that allocating income into three distinct categories allows for better control and understanding of one's finances. The rule has since gained popularity and has been widely adopted by individuals looking to improve their financial management skills.

Benefits of the 50-30-20 Budget Rule

There are several benefits to following the 50-30-20 budget rule. First and foremost, it helps you stay on top of your finances by accounting for every dollar you earn. By dividing your income into needs, wants, and savings, you can ensure that you are covering your essential expenses, enjoying your life with discretionary spending, and saving for the future.

Additionally, the 50-30-20 budget rule provides a balanced approach to budgeting. By allocating 50% to needs, 30% to wants, and 20% to savings, you are creating a financial plan that takes into account both short-term and long-term goals. This balance can help reduce financial stress and provide a sense of control over your money.

Breaking Down the 50-30-20 Budget Rule

To understand the 50-30-20 budget rule better, let's break down each category and explore what they entail.

50% for Needs

The needs category comprises essential expenses that are necessary for your day-to-day living. These expenses typically include:

- Rent/Mortgage: Your monthly housing payment is a significant portion of your needs. It is important to allocate a portion of your budget towards this expense to ensure that you have a roof over your head.

- Healthcare: Medical expenses, insurance premiums, and healthcare-related costs fall under the needs category. It is crucial to prioritize your health and allocate funds for healthcare expenses.

- Groceries: Food is a basic necessity, and allocating a portion of your budget towards groceries is essential for maintaining a healthy and balanced diet.

- Debt Payments: If you have any outstanding debts, such as credit card debt or student loans, allocating a portion of your budget towards debt repayment is crucial for managing your financial obligations.

30% for Wants

The wants category covers non-essential expenses that add enjoyment and quality to your life. While these expenses are not necessary for survival, they contribute to your overall well-being and satisfaction. Some examples of wants include:

- Dining Out: Treating yourself to a meal at a restaurant or ordering takeout is a common indulgence. Allocating funds for dining out allows you to enjoy social outings and culinary experiences.

- Entertainment: Going to see a movie, attending concerts or sporting events, or enjoying other forms of entertainment fall under the wants category. These activities add variety and enjoyment to your life.

- Luxury Purchases: Buying non-essential items like designer clothing, electronics, or other luxurious goods can be categorized as wants. These purchases add a sense of luxury and enjoyment to your life.

20% for Savings

The savings category is dedicated to building your financial security and planning for the future. It is important to allocate a portion of your income towards savings to ensure you have funds for emergencies, retirement, and investments. The savings category includes:

- Building an Emergency Fund: Setting aside money for unexpected expenses or emergencies is crucial for financial stability. The emergency fund acts as a safety net and can prevent you from going into debt during challenging times.

- Saving for Retirement: Allocating funds towards retirement ensures that you are financially prepared for your golden years. By saving consistently, you can build a nest egg that will provide you with a comfortable retirement.

- Investing: Investing your funds allows you to grow your wealth over time. Whether it's in stocks, real estate, or other investment vehicles, allocating a portion of your budget towards investments can help you achieve long-term financial goals.

This image is property of images.unsplash.com.

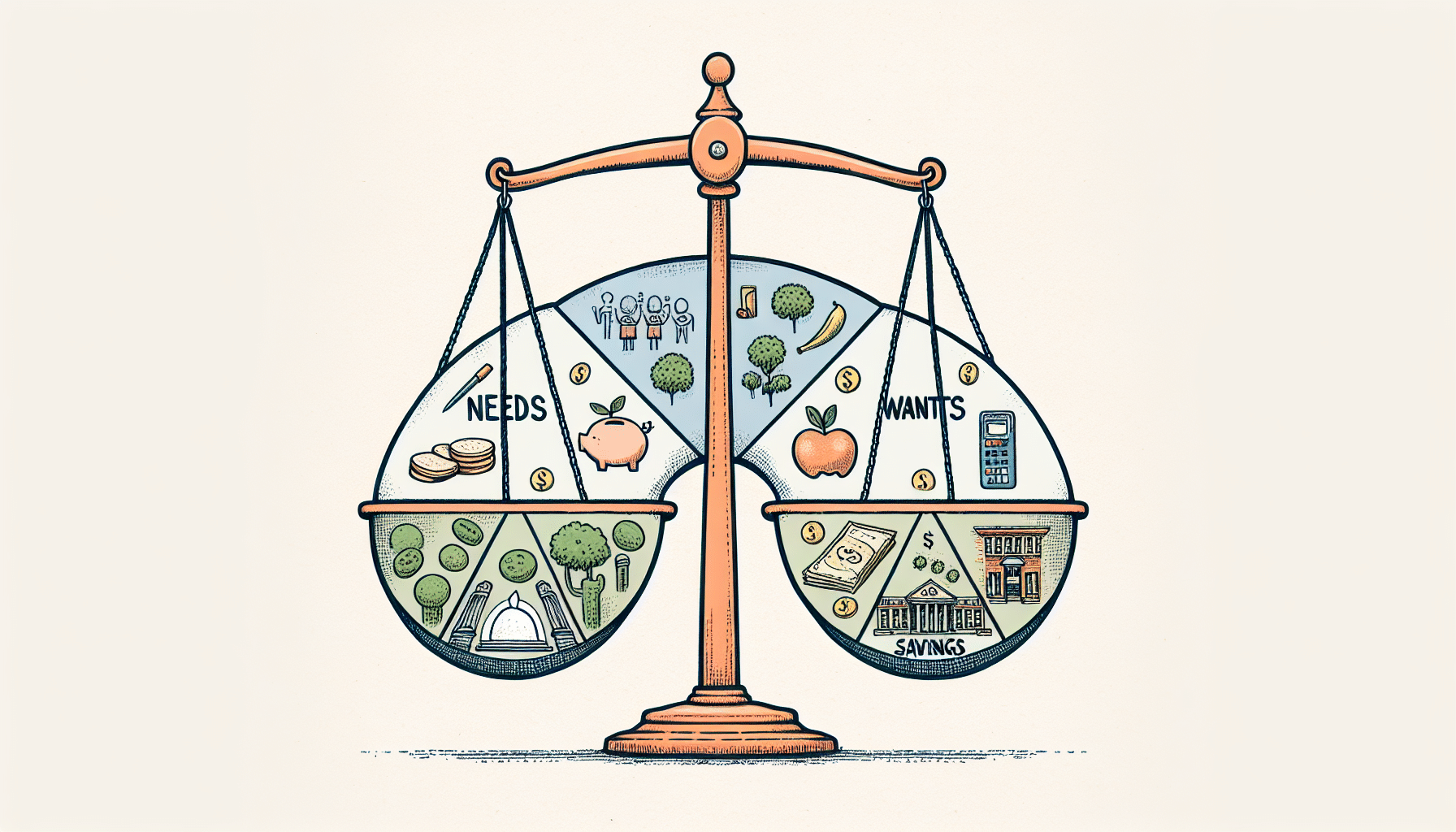

Customizing the 50-30-20 Budget Rule

While the 50-30-20 budget rule provides a general guideline for budgeting, it is important to customize it to fit your individual circumstances. Everyone's financial situation is unique, and what works for one person may not work for another. Here are a few considerations to keep in mind when customizing the 50-30-20 budget rule:

Adapting the Percentages

If the 50-30-20 breakdown doesn't fit your financial situation, feel free to adjust the percentages to better suit your needs. For example, if you have high rent or mortgage payments, you may need to allocate a larger percentage towards needs. Alternatively, if you have low expenses in any particular category, you may choose to allocate more towards savings or wants.

Considering Individual Circumstances

It's important to consider your own financial goals and circumstances when customizing the budget rule. For instance, if you are aggressively paying off debt, you may allocate a larger percentage towards debt payments. On the other hand, if you have already built a substantial emergency fund, you may allocate a smaller percentage towards savings and more towards wants or debt repayment.

Finding a Balanced Budget

The goal of customization is to create a budget that aligns with your financial goals and priorities. By finding the right balance between needs, wants, and savings, you can create a budget that works for you and allows you to achieve your financial objectives.

Implementing the 50-30-20 Budget Rule

Implementing the 50-30-20 budget rule can be made easier by following a few key steps. Here's how you can get started:

Using a Budget Template

A 50-30-20 budget template can be a helpful tool in implementing the budget rule. You can find various budget templates online or create your own using spreadsheet software. The template will help you allocate your income into the appropriate categories and keep track of your expenses.

Tracking Expenses

To effectively implement the 50-30-20 budget rule, it is important to track your expenses regularly. By monitoring how you are spending your money, you can identify areas where you may need to adjust your budget. There are numerous apps and tools available that can help you track your expenses effortlessly.

Prioritizing Debt Repayment

If you have outstanding debts, it is crucial to prioritize debt repayment within your budget. By allocating a portion of your income towards debt payments, you can work towards becoming debt-free and improving your overall financial well-being. Consider using the debt avalanche or debt snowball method to pay off your debts more efficiently.

This image is property of images.unsplash.com.

Applying the 50-30-20 Budget Rule

The 50-30-20 budget rule can be applied to both weekly and monthly budgets. Depending on your income frequency and financial obligations, you can choose the timeframe that works best for you. Here are a few tips for applying the budget rule:

Weekly Budget Application

If you prefer to budget on a weekly basis, divide your after-tax income into the 50-30-20 categories accordingly. Calculate your weekly needs, wants, and savings amounts and allocate the funds accordingly. This will help you stay on top of your expenses and adjust your budget as needed.

Monthly Budget Application

For those who prefer to budget on a monthly basis, calculate your monthly needs, wants, and savings amounts based on your after-tax income. Break down your expenses for the month and ensure that you are staying within your allocated percentages. Adjust your budget as necessary and track your progress throughout the month.

Flexibility in Budgeting

It's important to remember that budgeting is not a one-size-fits-all approach. Life circumstances may change, and your budget may need to be adjusted accordingly. The 50-30-20 budget rule provides a framework, but it should be flexible enough to accommodate unforeseen expenses or changes in income. Regularly reviewing and adjusting your budget will help you stay on track and achieve your financial goals.

Exploring Other Budgeting Variations

While the 50-30-20 budget rule is an effective guideline for many individuals, it may not suit everyone's circumstances. There are other variations of budgeting rules that you may consider, depending on your needs and financial goals. Here are a few examples:

80-20 Budget Rule

The 80-20 budget rule is a more stringent approach to budgeting. It suggests allocating 80% of your income towards needs and savings, leaving only 20% for wants. This rule is ideal for individuals who want to prioritize savings and financial stability over discretionary spending.

70-20-10 Budget Rule

The 70-20-10 budget rule is another variation that focuses on savings and investments. With this rule, you allocate 70% of your income towards needs, 20% towards savings, and 10% towards investments. This rule is suitable for individuals who want to prioritize building wealth and financial independence.

When the 50-30-20 Rule Doesn't Fit

There may be instances where the 50-30-20 budget rule simply doesn't fit your circumstances. For example, if you have high medical expenses or are facing temporary financial difficulties, you may need to allocate more towards needs and less towards wants or savings. In such cases, it is important to assess your individual circumstances and adjust your budget accordingly.

Conclusion

The 50-30-20 budget rule provides a simple and effective framework for allocating your income into needs, wants, and savings. By following this rule, you can gain control over your finances, make informed spending decisions, and work towards your financial goals. While customization is key to fitting the rule to your unique circumstances, the 50-30-20 budget rule offers a balanced approach that can lead to improved financial well-being. So, take control of your finances, implement the 50-30-20 budget rule, and pave the way to a brighter financial future.