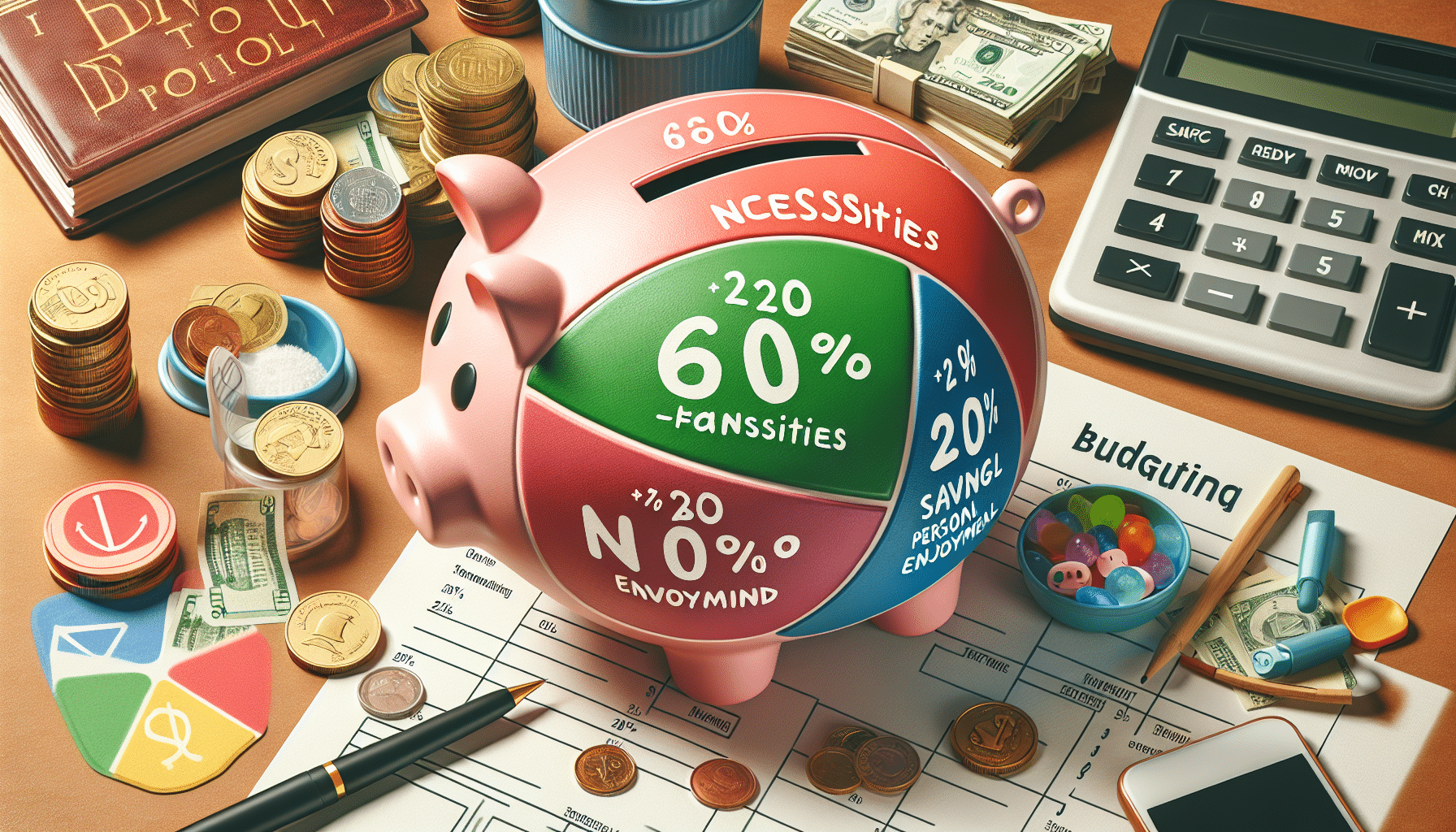

If you're looking for a simple and effective way to manage your finances, then the 60-20-20 rule might be just what you need. This budgeting method divides your income into three categories: 60% for expenses, 20% for savings, and 20% for wants. By following this rule, you can save more and spend less, all while maintaining a flexible spending plan. With easy implementation and a focus on prioritizing savings goals, the 60-20-20 rule is a practical approach to budgeting that can help you achieve financial stability. Keep reading to learn how to create a 60-20-20 budget, as well as some useful tips for successful budgeting. And if this method doesn't quite fit your needs, don't worry - there are alternative budgets you can explore as well.

This image is property of images.pexels.com.

What is the 60-20-20 rule?

The 60-20-20 rule is a simple and effective budgeting method that can help you save more, spend less, and achieve your financial goals. It is a percentage-based budget, where 60% of your income goes towards necessities or living expenses, 20% goes towards savings, and the remaining 20% goes towards wants or non-necessities.

Definition of the 60-20-20 rule

The 60-20-20 rule is a budgeting principle that allocates a specific percentage of your income to different spending categories. It is a popular approach because it provides a clear guideline for managing your money and ensures that you are saving and spending in a balanced way.

The purpose of the 60-20-20 budget

The purpose of the 60-20-20 budget is to help you create a sustainable and balanced financial plan. By allocating specific percentages of your income to different categories, you can prioritize your savings goals while still allowing yourself some flexibility to enjoy non-essential purchases.

Explanation of the three spending categories

The three spending categories in the 60-20-20 rule are living expenses, savings, and non-necessities.

-

Living expenses: This category includes all the necessary expenses for your day-to-day life, such as rent or mortgage payments, utilities, groceries, transportation, and healthcare costs. By allocating 60% of your income to this category, you ensure that your essential needs are met.

-

Savings: This category is crucial for building a financial safety net and achieving long-term goals. It includes contributions to your emergency fund, retirement savings, investments, and any other financial goals you may have. Allocating 20% of your income to savings helps you build wealth and secure your financial future.

-

Non-necessities: The remaining 20% of your income is allocated to non-necessities or wants. This category allows you to enjoy discretionary spending on things like dining out, entertainment, hobbies, vacations, and other non-essential purchases. It provides you with a sense of financial freedom while still maintaining financial responsibility.

Benefits of the 60-20-20 rule

The 60-20-20 rule offers several benefits that can positively impact your financial well-being.

Flexible spending

One of the key advantages of the 60-20-20 rule is its flexibility. By allocating a portion of your income to non-necessities, you have the freedom to spend guilt-free on things that bring you joy and enhance your quality of life. This flexibility helps to prevent burnout and promotes a healthier relationship with money.

Easy implementation

The 60-20-20 rule is easy to understand and implement, making it suitable for individuals of all financial literacy levels. With clear guidelines on how to allocate your income, it simplifies the budgeting process and provides a framework for managing your money effectively. This simplicity can make budgeting feel less overwhelming and more achievable.

Prioritizing savings goals

By allocating 20% of your income to savings, the 60-20-20 rule ensures that saving becomes a priority. This systematic approach helps you build an emergency fund, save for retirement, make investments, and achieve other financial goals. It encourages healthy financial habits and empowers you to take control of your financial future.

This image is property of images.pexels.com.

Using the 60-20-20 rule

Implementing the 60-20-20 rule involves several steps to ensure accuracy and effectiveness.

Calculating your net pay

To create a 60-20-20 budget, it is important to use your net pay, which is your income after taxes and deductions. Calculating your net pay gives you a realistic picture of the funds available to allocate to the different spending categories.

Dividing your income

Once you have determined your net pay, divide it into three categories: 60% for living expenses, 20% for savings, and 20% for non-necessities. This division ensures that your income is allocated proportionately and helps you maintain balance in your financial plan.

Listing expenses

Create a comprehensive list of your living expenses, including rent or mortgage payments, utilities, insurance, groceries, transportation costs, healthcare expenses, and any other necessary bills. This step allows you to have a clear understanding of your essential expenses and helps you set realistic budgeting targets.

Adjusting spending to fit the categories

To implement the 60-20-20 rule effectively, you may need to adjust your spending habits to fit the assigned categories. If your living expenses exceed 60% of your income, you may need to evaluate your spending and find areas where you can cut back. Similarly, you may need to reduce or eliminate some non-necessities to ensure that they fit within the allocated 20%.

Considerations for the 60-20-20 rule

While the 60-20-20 rule is a useful budgeting method for many individuals, it may not be suitable for everyone.

Suitability for different income levels

The 60-20-20 rule may not work as effectively for individuals with lower incomes. When living expenses consume a larger proportion of your income, it can be challenging to allocate only 60% towards necessities. In such cases, you may need to consider alternative budgeting methods that provide more flexibility or adjust the percentages to better suit your financial situation.

Impact of high cost of living

Individuals living in areas with a high cost of living may find it difficult to allocate only 60% of their income towards living expenses. In these situations, it is important to consider the local economic conditions and adjust the budget percentages accordingly. You may need to allocate a larger percentage to living expenses to ensure that your essential needs are met.

Managing debt with the 60-20-20 budget

If you have substantial debt, such as student loans, credit card debt, or a mortgage, the 60-20-20 rule may not provide sufficient allocation for debt repayment. In these cases, it is crucial to prioritize debt management and consider alternative budgeting methods that allow for larger debt payments. It may be necessary to allocate a portion of your savings or non-necessities towards debt repayment to accelerate the process.

This image is property of images.pexels.com.

Tips for successful budgeting

To make the most of the 60-20-20 rule, consider the following tips for successful budgeting:

Setting clear money goals

Define your financial objectives and set clear money goals. Whether it is saving for retirement, buying a house, or paying off debt, having specific goals gives your budget purpose and helps motivate you to stick to it.

Calculating variable expenses

In addition to your fixed living expenses, factor in variable expenses such as entertainment, dining out, and other discretionary spending. By estimating these expenses accurately, you can avoid overspending and ensure that they fit within the allocated 20% for non-necessities.

Adjusting your budget as life changes

As life circumstances change, it is important to adjust your budget accordingly. Factors such as job changes, additional dependents, or unexpected expenses may require you to reassess your income allocation and adjust the percentages to better suit your new circumstances.

Regularly revisiting your budget

Keep a close eye on your budget and regularly review it to ensure that you are staying on track. Periodically evaluate your spending habits, savings progress, and financial goals, and make adjustments as needed. Regularly revisiting your budget ensures that it remains relevant and effective in helping you achieve your financial aspirations.

Alternative budgeting methods

While the 60-20-20 rule is a popular budgeting method, there are alternative approaches you can explore to find the one that best suits your financial needs and goals.

Overview of alternative budgets

Some alternative budgeting methods include:

- The 50-30-20 budget: Similar to the 60-20-20 rule, this method allocates 50% of your income to needs, 30% to wants, and 20% to savings.

- The zero-sum method: With this method, every dollar of your income is assigned to a specific category. It helps you track your spending meticulously and ensures that every dollar has a purpose.

- The 70-20-10 budget: This budgeting method allocates 70% of your income to living expenses, 20% to savings, and 10% to non-necessities.

- The 60-30-10 rule: This approach assigns 60% of your income to living expenses, 30% to wants, and 10% to savings.

- The 30-30-30-10 rule: This budgeting method divides your income into four spending categories, with 30% allocated to living expenses, 30% to savings, 30% to debt repayment, and 10% to charity or other giving.

Exploring these alternative budgeting methods can help you find a system that aligns with your financial goals, priorities, and lifestyle.

In conclusion, the 60-20-20 rule is an effective budgeting method that provides a clear framework for managing your money, prioritizing savings, and allowing for non-essential spending. By allocating percentages of your income to different spending categories, you can achieve a balanced financial plan and work towards your long-term goals. Remember to consider your income level, cost of living, and any outstanding debt when implementing this approach, and adjust as necessary to ensure its suitability for your specific circumstances. Additionally, exploring alternative budgeting methods can help you find the system that works best for you. With discipline, regular evaluation, and a clear understanding of your financial goals, the 60-20-20 rule can be a valuable tool in helping you achieve financial success.