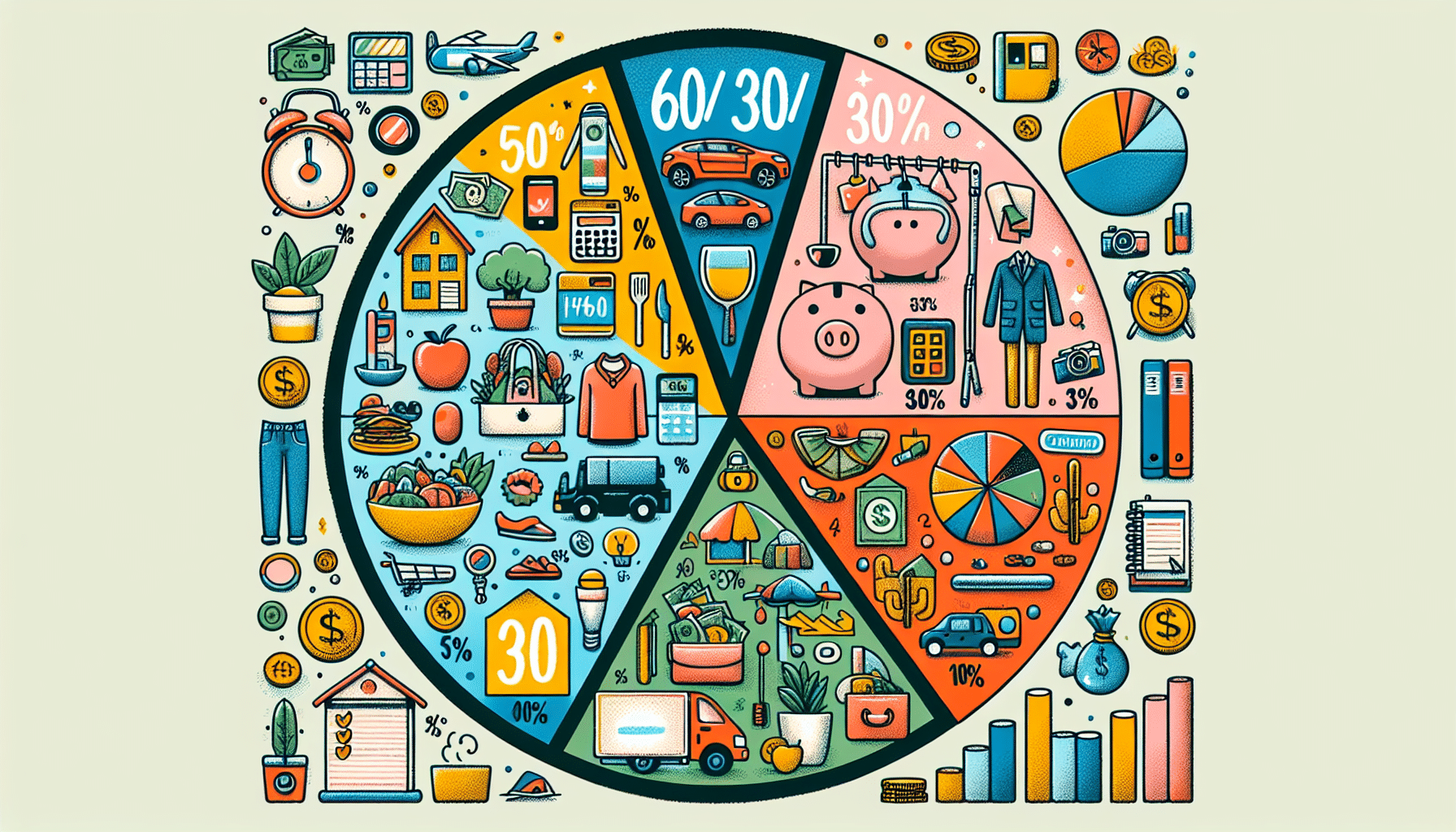

Imagine a budgeting rule that not only helps you save money but also prioritizes achieving your goals. Well, that's where the 60 30 10 rule comes in. With this rule, you allocate 60% of your take-home pay towards savings, investing, or debt repayment, ensuring that you are building a secure financial future. The next 30% goes towards essential needs like housing, food, transportation, and healthcare, ensuring that your basic necessities are met. Lastly, the remaining 10% is for discretionary spending on wants, allowing you to indulge in the things that bring you joy. The 60 30 10 rule is perfect for those with ambitious savings goals, as it fosters disciplined spending while making faster progress towards achieving financial milestones. While it may require some adjustments to your lifestyle and limit discretionary spending, this budgeting style can pave the way for a brighter financial future. And if this particular budgeting method doesn't suit your needs, there are always alternatives like the 70-20-10 budget or the 80/20 rule to explore.

Benefits of the 60 30 10 Rule

Faster progress towards financial goals

One of the key benefits of following the 60 30 10 rule is that it allows you to make faster progress towards your financial goals. By allocating 60% of your take-home pay towards savings, investing, or debt repayment, you are actively setting aside a significant portion of your income to work towards achieving your goals. This can help you to build an emergency fund, pay off debt faster, or save for major purchases like a down payment on a house or a dream vacation.

The 60% allocation towards financial goals ensures that you are consistently saving and working towards your goals, which can accelerate your progress and help you reach them sooner than if you were only saving a smaller percentage of your income. This can be especially beneficial for individuals who prioritize long-term financial stability and want to make substantial progress in a shorter amount of time.

Disciplined spending on priorities

Another advantage of the 60 30 10 rule is that it promotes disciplined spending on your priorities. By dedicating 30% of your take-home pay towards essential needs such as housing, food, transportation, and healthcare, you are ensuring that your basic needs are met while still leaving room for discretionary spending. This allows you to budget wisely and prioritize your spending based on what matters most to you.

The 10% allocation towards wants gives you the freedom to spend on non-essential items without feeling guilty or overspending. This portion of your budget is meant to be used for things that bring you joy and enhance your quality of life, whether it's going out for dinner with friends, treating yourself to a spa day, or indulging in a hobby or passion. By adhering to this rule, you are able to strike a balance between responsible financial management and enjoying life's little pleasures.

Drawbacks of the 60 30 10 Rule

This image is property of images.unsplash.com.

Limited discretionary spending options

While the 60 30 10 rule offers many advantages, it does come with some limitations. One potential drawback is that it may limit your discretionary spending options. With only 10% of your take-home pay allocated towards wants, you may need to be more conscious of your spending in this category. This means that you may have to forgo certain luxuries or non-essential purchases in order to stick to your budget.

While this discipline can be beneficial in terms of financial responsibility, it may require some level of sacrifice or prioritization when it comes to discretionary spending. This can be challenging for individuals who enjoy indulging in various wants or hobbies, as they may find it difficult to adhere strictly to the 10% limit.

Potential adjustments to lifestyle

Another potential drawback of the 60 30 10 rule is that it may require adjustments to your lifestyle. Depending on your financial goals and the current state of your finances, allocating 60% towards financial goals and 30% towards needs may require some lifestyle changes in order to make the budget work.

For example, if you are currently spending more than 30% of your income on needs, you may need to reassess your housing situation, find ways to lower your transportation costs, or cut back on certain expenses in order to adhere to the rule. Additionally, if 60% towards financial goals is too aggressive for your current income level, you may need to find ways to increase your income or make cuts in other areas of your budget in order to make the rule work for you.

It's important to keep in mind that these potential adjustments are not permanent and are meant to help you achieve your long-term financial goals. While they may require some sacrifices in the short-term, the benefits of faster progress towards your goals and disciplined spending can ultimately outweigh the need for lifestyle adjustments.

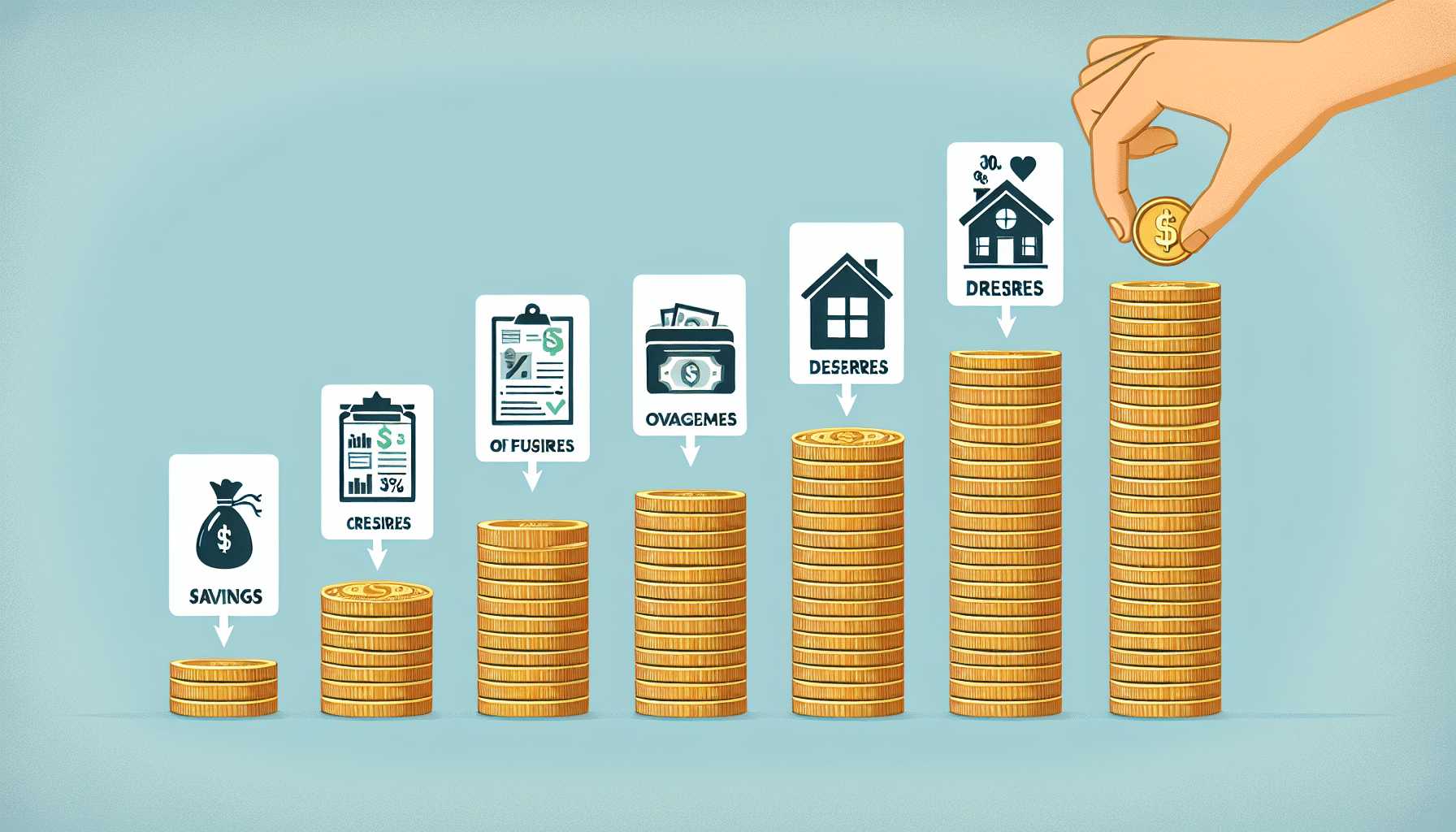

Setting Up a 60 30 10 Rule Budget

This image is property of images.unsplash.com.

Determine your take-home pay

To set up a 60 30 10 rule budget, the first step is to determine your take-home pay. This is the amount of money you receive after taxes and deductions have been taken out of your paycheck. Knowing your take-home pay is essential in order to accurately allocate the appropriate percentages towards your financial goals, needs, and wants.

Make sure to take into account any fluctuations in income, such as bonuses or commissions, as these may affect your budgeting percentages. It's also important to factor in any recurring expenses or obligations that may impact your overall budget.

Allocate 60% to financial goals

Once you have determined your take-home pay, allocate 60% of this amount towards your financial goals. This can include savings for emergencies, retirement contributions, paying off debt, or investing for the future. The key is to prioritize your long-term financial stability and allocate a significant portion of your income towards achieving these goals.

You can set up automatic transfers or contributions to make this process easier and ensure that the allocated amount goes towards your financial goals consistently and on time. By consistently allocating 60% towards your financial goals, you are setting yourself up for faster progress and long-term financial success.

This image is property of images.unsplash.com.

Allocate 30% to needs

After allocating 60% towards your financial goals, allocate 30% of your take-home pay towards essential needs. This category includes expenses such as housing (rent or mortgage payments), groceries, transportation costs, healthcare expenses, and other basic necessities.

It's important to budget carefully within this category and prioritize your needs. Look for ways to reduce expenses or find more affordable alternatives without sacrificing quality or safety. For example, you can consider meal planning and cooking at home instead of dining out frequently to save on food expenses, or you can explore public transportation options to reduce transportation costs.

By allocating 30% towards needs, you are ensuring that your basic necessities are met while still leaving room for discretionary spending and savings towards your financial goals.

Allocate 10% to wants

The remaining 10% of your take-home pay should be allocated towards wants. This category includes non-essential items or experiences that bring you joy and enhance your quality of life. This can range from dining out at your favorite restaurant, going to a concert, buying new clothes, or indulging in hobbies or leisure activities.

While it may be tempting to exceed the 10% limit, it's important to stick to this allocation in order to maintain balance and discipline in your budget. By allocating a smaller percentage towards wants, you are prioritizing responsible financial management while still allowing yourself some flexibility to enjoy the things that bring you happiness.

Adjusting the 60 30 10 Rule Budget

While the 60 30 10 rule can be a great budgeting strategy for many individuals, it may not be suitable for everyone's financial situation. If you find that this budgeting method is not working for you, there are ways to adjust and make it more manageable.

Increasing income

One way to adjust the 60 30 10 rule budget is by increasing your income. This can be achieved through various means such as asking for a raise or promotion at work, taking on a side job or freelance work, or exploring passive income streams. By increasing your income, you can allocate a higher percentage towards your financial goals and needs, making it easier to adhere to the rule.

While increasing your income may require additional time and effort, it can provide you with more financial flexibility and make it easier to reach your financial goals. Be proactive in seeking opportunities to increase your income and consider investing in your skills and education to enhance your earning potential.

Making cuts

Another way to adjust the 60 30 10 rule budget is by making cuts in other areas of your budget. Look for expenses that can be reduced or eliminated to free up more money for your financial goals and needs. This may require you to reassess your spending habits and make adjustments accordingly.

For example, you can consider cutting back on dining out, subscription services, or entertainment expenses in order to allocate more towards your financial goals. Evaluate each expense and determine whether it aligns with your priorities and long-term financial goals. By making intentional cuts, you can create more room within the budget and make the 60 30 10 rule more sustainable for your current financial situation.

Alternatives to the 60 30 10 Rule

While the 60 30 10 rule can be an effective budgeting strategy for many individuals, it's not the only method available. Here are a couple of alternatives to consider:

70-20-10 budget

The 70-20-10 budget is another popular budgeting method that focuses on saving, living expenses, and discretionary spending. Under this rule, 70% of your take-home pay is allocated towards living expenses and essential needs, 20% is dedicated to savings and financial goals, and 10% is reserved for discretionary spending.

This alternative allows for a slightly higher percentage towards living expenses and essentials while still emphasizing the importance of saving and discretionary spending. It provides a bit more flexibility compared to the 60 30 10 rule, which may be beneficial for individuals with different financial obligations or priorities.

80/20 rule

The 80/20 rule, also known as the Pareto Principle, is a budgeting method that advocates for saving 20% of your income and using the remaining 80% for expenses and discretionary spending. This rule is particularly useful for individuals who want to prioritize saving and investing while maintaining a larger portion of their income for expenses.

With the 80/20 rule, there is more flexibility in terms of how the 80% is allocated towards expenses, needs, and wants. This can be beneficial for individuals who prefer a more customizable budgeting approach based on their unique financial situation and goals.

Ultimately, it's important to choose a budgeting strategy that aligns with your financial goals, priorities, and lifestyle. Whether you decide to follow the 60 30 10 rule, explore alternatives, or create a customized budgeting plan, the key is to maintain discipline, consistently save, and make intentional choices when it comes to your finances.