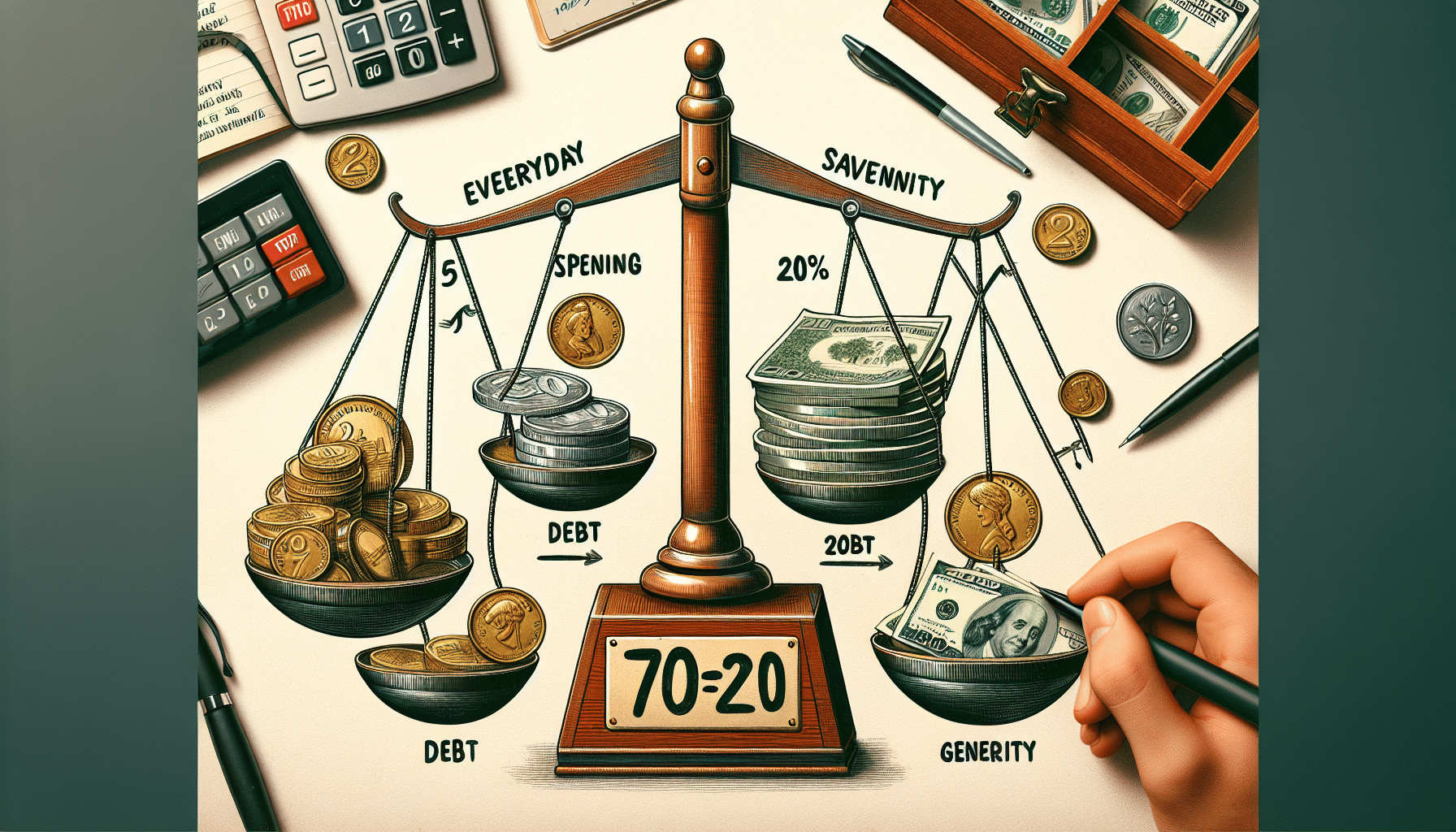

In the world of budgeting, the 70-20-10 budget has become a popular approach for managing finances. With this method, you allocate 70% of your income towards spending, 20% towards saving, and the remaining 10% towards debt payoff or giving. It's a simplified way to take control of your finances without getting bogged down in detailed and time-consuming budgeting processes. By calculating your income after taxes and dividing it into these three categories, you can easily stay on track and ensure you're prioritizing your financial goals. Whether it's saving for an emergency fund, paying off debt, or contributing to charitable causes, the 70-20-10 budget provides a flexible framework to adapt to your individual circumstances. Just remember, keeping track of your expenses and regularly monitoring your budget is crucial to sticking to those allocated percentages and achieving financial success.

This image is property of pixabay.com.

The 70-20-10 Budget

Budgeting can sometimes feel overwhelming and time-consuming, but it doesn't have to be. With the 70-20-10 budget, you can simplify the process and still effectively manage your finances. This budgeting method allocates 70% of your income for spending, 20% for saving, and 10% for debt payoff or charitable giving. In this article, we will dive into the details of the 70-20-10 budget and how you can implement it successfully.

What is the 70-20-10 budget?

The 70-20-10 budget is a simplified version of budgeting that provides a clear framework for managing your income. The numbers in the budget represent the percentages of your income that you should allocate to different categories: 70% for spending, 20% for saving, and 10% for debt payoff or giving.

Simplified budgeting method

One of the advantages of the 70-20-10 budget is its simplicity. Unlike traditional budgeting methods that require tracking every single expense, the 70-20-10 budget focuses on allocating percentages to broad categories. This makes it easier to implement and less time-consuming.

Allocation of income

When implementing the 70-20-10 budget, the first step is to calculate your income after taxes. This will give you a clear understanding of the amount of money you have available to allocate to the different categories. Once you have your post-tax income, you can start allocating the corresponding percentages.

Implementing the 70-20-10 Budget

Calculating income after taxes

To accurately implement the 70-20-10 budget, it is important to calculate your income after taxes. This can be done by subtracting your tax deductions from your gross income. By having a clear understanding of your post-tax income, you can better plan and allocate your money.

Allocating percentages

After calculating your income after taxes, it's time to allocate the percentages to the different categories. Remember, 70% goes towards spending, 20% towards saving, and 10% towards debt payoff or charitable giving. These percentages are a guideline to help you prioritize your financial goals and control your spending.

Including all expenses in the spending category

When allocating the 70% of your income for spending, it is important to include all expenses. This includes both fixed expenses like rent, utilities, and subscriptions, as well as variable expenses like groceries, entertainment, and dining out. By considering all expenses, you can have a more accurate picture of your spending habits and make necessary adjustments.

This image is property of pixabay.com.

The Saving Category

Aim of saving 20% of income

The saving category in the 70-20-10 budget aims to save 20% of your total income. Saving money is crucial for building an emergency fund, reaching financial goals, and preparing for the future. By making saving a priority, you can set yourself up for long-term financial success.

Emergency fund

Part of the saving category should be allocated towards building an emergency fund. An emergency fund is a safety net that provides financial security in case of unexpected expenses or emergencies. It is recommended to have at least three to six months' worth of living expenses saved in an emergency fund.

Sinking funds

In addition to an emergency fund, consider creating sinking funds within the saving category. Sinking funds are savings accounts dedicated to specific future expenses, such as vacations, car repairs, or home renovations. By setting money aside in sinking funds, you can avoid going into debt when these expenses arise.

Retirement savings inclusion

When allocating the 20% for saving, it is important to include retirement savings as well. Saving for retirement is crucial for ensuring financial stability in your later years. Consider contributing to retirement accounts like a 401(k) or an IRA to build a nest egg for your future.

The Debt Payoff or Giving Category

Allocation of remaining 10%

After allocating 70% for spending and 20% for saving, the remaining 10% of your income should be allocated towards debt payoff or charitable giving. This category allows you to focus on reducing your debt or giving back to causes that are important to you.

Options for debt payoff

If you have debt, whether it is credit card debt, student loans, or a mortgage, allocating a portion of your income towards debt payoff can help you make progress towards becoming debt-free. Consider using the debt snowball or debt avalanche method to prioritize and pay off your debts.

Charitable giving

If you don't have any debt or if you have already made significant progress towards paying it off, you can allocate the 10% towards charitable giving. Giving back to your community or supporting causes that are meaningful to you can bring a sense of purpose and fulfillment to your financial journey.

Flexibility of the 70-20-10 Budget

The beauty of the 70-20-10 budget is its flexibility. It provides a framework for managing your finances, but it can be adjusted based on your individual circumstances. If your financial situation changes, you can adapt the percentages to better meet your needs and goals. The key is to find a balance that works for you and allows you to make progress towards your financial objectives.

Tracking and Monitoring

Importance of tracking

To successfully implement the 70-20-10 budget, it is essential to track and monitor your spending, saving, and debt payoff or giving. Tracking your expenses can help you identify areas where you may be overspending and make necessary adjustments. Monitoring your progress towards your financial goals can provide motivation and keep you on track.

Sticking to allocated percentages

Sticking to the allocated percentages is crucial for the success of the 70-20-10 budget. While it may be tempting to overspend in the spending category or neglect saving and debt payoff or giving, it is important to stay disciplined and prioritize your financial goals. Regularly reviewing your budget and making adjustments as needed can help you maintain balance and achieve financial success.

In conclusion, the 70-20-10 budget is a straightforward and effective way to manage your finances. By allocating 70% of your income for spending, 20% for saving, and 10% for debt payoff or giving, you can balance your needs and priorities while working towards your financial goals. Remember to track and monitor your budget, make necessary adjustments, and stay disciplined in order to make the most of this budgeting method.

This image is property of pixabay.com.