If you're looking for an effective and tangible method to manage your budget, look no further than the cash envelope system. This system provides a practical way to allocate your funds and track your expenses. By choosing the right cash envelope categories, you can reap various benefits, including avoiding impulsive spending, improving your savings, gaining a better understanding of your finances, and identifying where your money is being spent. With options ranging from rent/mortgage and utilities to fun spending money and emergency funds, there are 20 different categories to consider. The best part is that you have the flexibility to switch up your envelopes as needed, and you can easily label them using a digital or physical system. Whether you prefer organizing with a filing system or a cash envelope wallet, the choice is yours. This budgeting approach is a fantastic way to take control of your finances and achieve your financial goals.

Benefits of Using the Cash Envelope System for Managing Your Budget

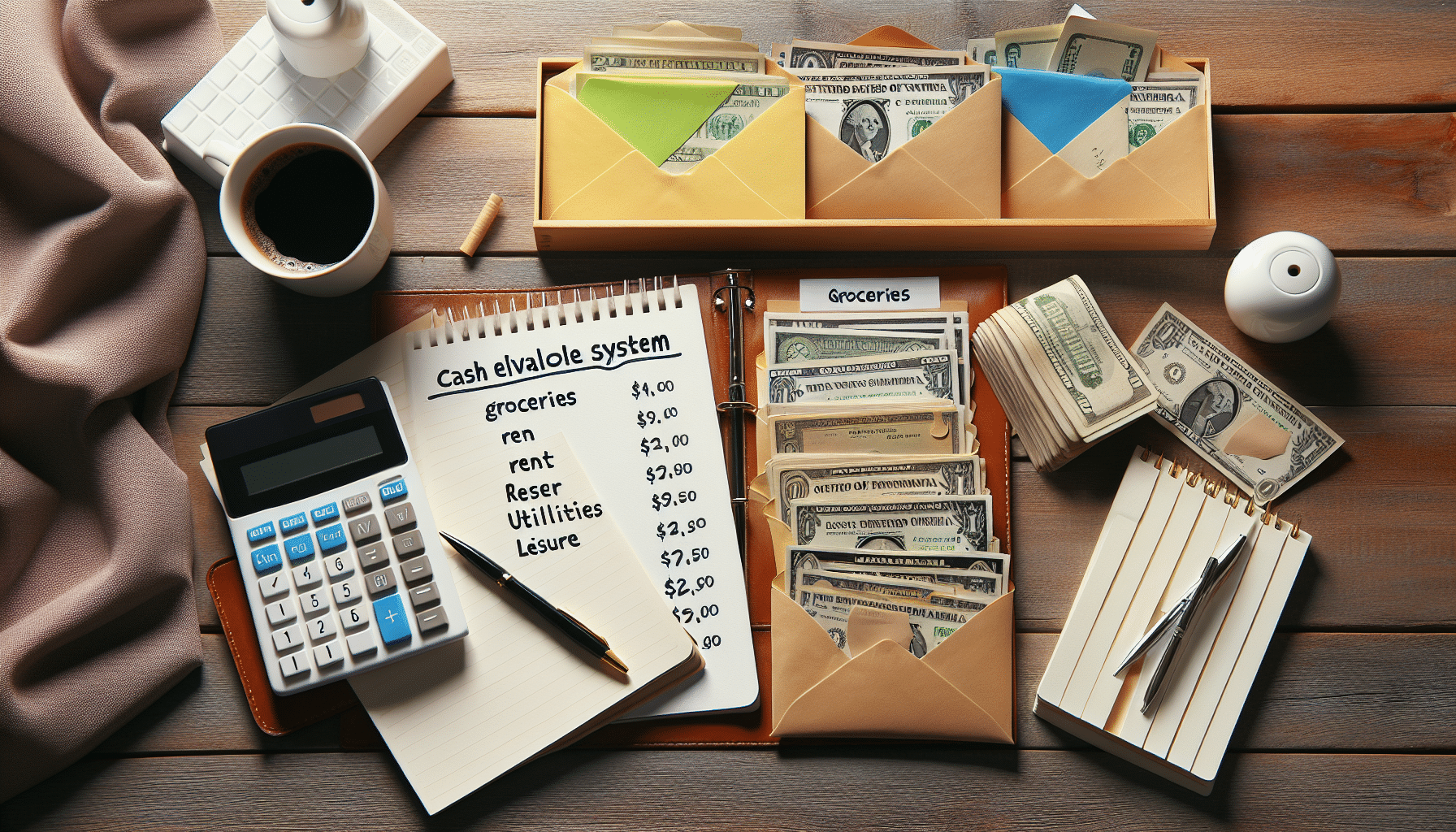

Introduction to the Cash Envelope System

Managing your budget effectively is essential for financial stability and achieving your financial goals. One popular method of budgeting is the cash envelope system, which utilizes physical cash and envelopes to allocate funds for different categories of expenses. By using this system, you can gain better control over your spending, increase your savings, and develop a deeper understanding of your financial habits.

Choosing the Right Cash Envelope Categories

One of the key factors in successfully implementing the cash envelope system is choosing the right categories for your envelopes. This step requires careful consideration of your needs and priorities. Start by assessing your monthly expenses and identifying the areas where you tend to overspend or where there is room for improvement. This will help you allocate the appropriate amount of cash for each category and ensure that you are effectively managing your budget.

This image is property of images.pexels.com.

Improved Financial Discipline and Avoidance of Impulse Spending

One of the greatest benefits of the cash envelope system is that it helps improve your financial discipline and prevents impulse spending. When you use cash for your expenses, you become acutely aware of the money leaving your hands. This physical connection to your spending acts as a powerful deterrent against impulse purchases. By only using the allocated cash in each envelope, you are forced to make deliberate spending decisions and prioritize your needs over wants.

Increase in Savings and Better Financial Management

Another advantage of using the cash envelope system is that it can lead to an increase in savings and better financial management. By allocating a specific amount of cash for savings each month, you are more likely to stick to your savings goals. The tangible nature of cash also makes it easier to track your progress and see your savings grow. Furthermore, the cash envelope system helps you prioritize your spending and ensures that your money is going towards your financial priorities rather than being wasted on unnecessary expenses.

This image is property of images.pexels.com.

Better Understanding of Finances and Tracking Expenses

The cash envelope system provides a unique opportunity to develop a better understanding of your finances and track your expenses more effectively. When you use cash for your day-to-day expenses, you are constantly aware of the money you have remaining in each envelope. This level of awareness allows you to closely monitor your spending habits and identify areas where adjustments can be made. By tracking your expenses, you gain valuable insights into your spending patterns and can make informed decisions about how to improve your financial situation.

Identification of Money Spending Patterns

One of the key benefits of using the cash envelope system is the ability to identify your money spending patterns. By physically handling cash and distributing it across different categories, you can easily see which areas of your budget are receiving the most attention and which are being neglected. This awareness can help you make necessary adjustments and reallocate funds as needed. By recognizing and addressing spending patterns, you can take control of your budget and ensure that your money is being used in the most beneficial way.

This image is property of images.pexels.com.

Increased Accountability and Responsibility

The cash envelope system promotes increased accountability and responsibility for your financial decisions. When you use cash instead of cards, you are forced to be more mindful of every transaction and think twice before making a purchase. This heightened level of responsibility encourages you to take control of your finances and make choices that align with your long-term goals. The act of physically handling cash also reinforces the value of money and the importance of making thoughtful spending decisions.

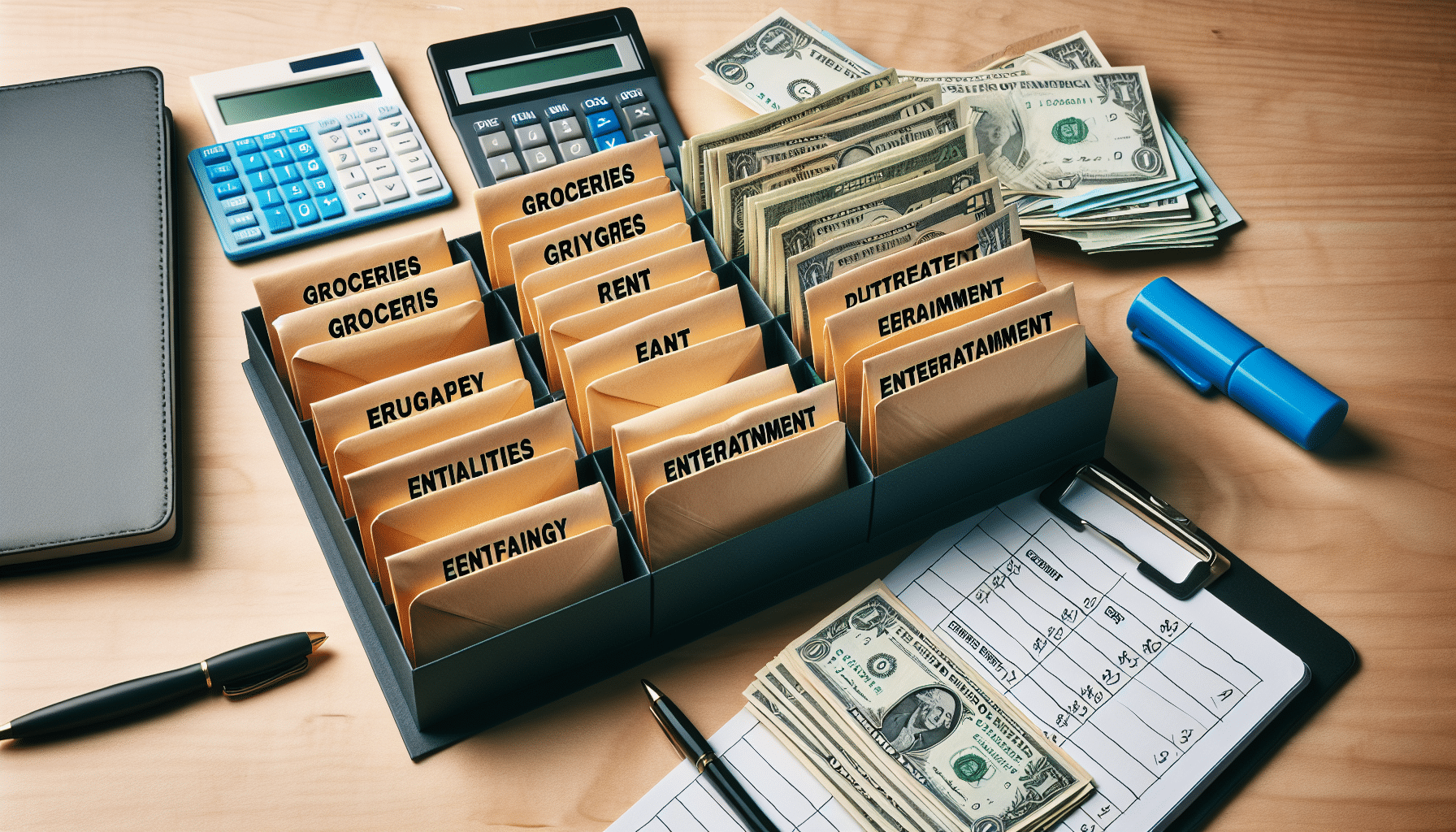

20 Cash Envelope Categories to Consider

When setting up your cash envelope system, it can be helpful to consider various categories to ensure you are covering all your expenses effectively. Here are 20 cash envelope categories to consider:

- Rent/Mortgage

- Utilities

- Food and Groceries

- Cleaning Products

- Household Items

- Transportation

- Eating Out

- Kids Fund

- Garden

- Personal Care

- Clothing and Shoes

- Fun Spending Money

- Vacations

- Makeup and Beauty

- Pet Fund

- Entertainment

- Events

- Date Nights

- Gifts

- Emergency Fund

By utilizing these categories, you can effectively allocate your cash and ensure that all aspects of your budget are accounted for. Feel free to adjust and customize these categories to best fit your individual needs and priorities.

Switching Up Envelope Categories as Needed

The beauty of the cash envelope system is its flexibility. As your financial situation and priorities change, you can easily switch up your envelope categories to reflect your new circumstances. For example, if you have accomplished a savings goal, you can reallocate that envelope to a different category that requires more attention. This adaptability allows you to continually fine-tune your budget and ensure that your spending aligns with your current goals and priorities.

Labeling Cash Envelopes for Easy Identification

To make the cash envelope system even more effective, it is essential to label each envelope for easy identification. This can be done using either a digital or physical labeling system. If you prefer a digital approach, you can use budgeting apps or spreadsheets to track and label your envelopes. If you prefer a physical system, consider using colored envelopes or label stickers to identify each category. The key is to create a system that works best for you and allows for easy identification of each envelope.

Organizing Cash Envelopes Using a Filing System or Wallet

To keep your cash envelopes organized and easily accessible, consider using a filing system or a cash envelope wallet. A filing system allows you to keep your envelopes in a designated place, such as a filing cabinet or a binder with labeled tabs for each category. This method ensures that your envelopes are neatly organized and prevents them from getting misplaced.

Alternatively, a cash envelope wallet provides a convenient and portable solution. These wallets are specifically designed to hold multiple envelopes and often include dividers to keep your cash categories separate. By using a cash envelope wallet, you can easily carry your budget with you wherever you go and make it convenient to access and use your cash envelopes.

In conclusion, the cash envelope system is a powerful tool for managing your budget effectively. By choosing the right cash envelope categories, you can improve your financial discipline, increase your savings, develop a better understanding of your finances, and identify spending patterns. Consider utilizing the 20 cash envelope categories provided as a starting point, and customize them to align with your needs and priorities. With proper organization and labeling, the cash envelope system can help you achieve your budgeting goals and gain control over your finances.