In the world of finance and legal matters, it's essential to grasp the concept of general liens. These powerful tools allow creditors to secure their debts by obtaining a legal claim on a wide variety of assets. Imagine this: you loaned a substantial amount of money to a friend, and they have defaulted on their payments. By understanding general liens, you'll gain insight into how you can protect and recover what you're owed. Let's explore the intricacies of general liens and discover how they can impact your financial future. So, what exactly is a general lien and how does it relate to debt?

Overview

A lien is a legal claim that allows a person or organization to hold property as security until a debt is paid or an obligation is fulfilled. In this article, we will focus on general liens and explore the differences between general and specific liens. We will also discuss the importance of understanding general liens in various legal and financial contexts.

Types of Liens

Liens can be categorized into different types based on their nature and origin. Understanding these different types can help individuals and businesses navigate the complexities of debt and financial obligations. Here are the main types of liens:

General Liens

A general lien is a broad legal claim that grants the holder the right to seize and sell any property owned by the debtor to satisfy the debt. Unlike specific liens, which are tied to a specific asset, a general lien covers all assets of the debtor, regardless of their nature or origin. General liens are typically granted as a result of a court judgment or a statutory provision.

Specific Liens

A specific lien, on the other hand, is tied to a particular asset or property. This type of lien gives the holder the right to seize and sell only the specified property to recover the debt. Examples of specific liens include mortgages, car loans, and unpaid repair bills.

Consensual Liens

Consensual liens are created by the mutual agreement of the parties involved. These liens are typically established through contracts, such as mortgages, car loans, or business financing agreements. In consensual liens, both parties voluntarily agree to the terms outlined in the contract, including the provision of security for the debt.

Statutory Liens

Statutory liens are created through laws or statutes. These liens are established without the need for a contractual agreement between the parties involved. Examples of statutory liens include tax liens, mechanic's liens, and judgment liens.

Judicial Liens

Judicial liens are liens that are created through a court judgment. When a court decides in favor of a creditor, it may grant a judgment lien, allowing the creditor to claim the debtor's property in satisfaction of the debt. Judicial liens can be either specific or general, depending on the circumstances surrounding the judgment.

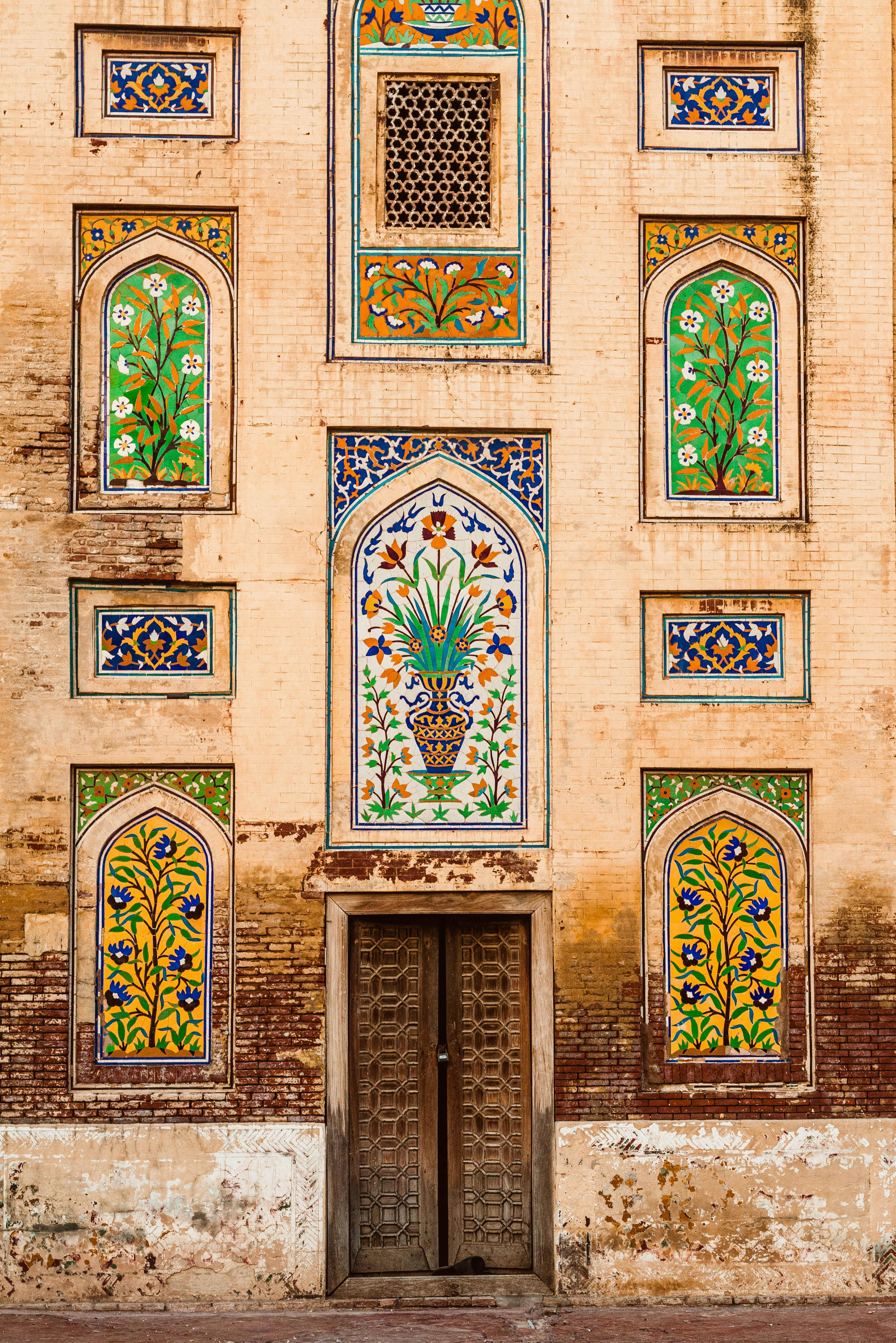

This image is property of images.pexels.com.

Understanding General Liens

Definition

A general lien is a powerful tool that allows a creditor to have a claim on all assets owned by the debtor, regardless of their nature or origin. It gives the creditor the right to seize and sell any property of the debtor to recover the outstanding debt.

Characteristics

There are several key characteristics of general liens that set them apart from other types of liens. First, general liens cover all assets of the debtor, providing the creditor with a wide scope of potential property to satisfy the debt. Second, general liens do not need to be tied to a specific asset or contract. Instead, they are granted based on a court judgment or a statutory provision. Lastly, general liens can be enforced through legal procedures, such as foreclosure and sale of the property.

Examples of General Liens

Examples of general liens include tax liens, judgment liens, and bankruptcy liens. In the case of tax liens, government authorities can place a lien on a taxpayer's property if they fail to pay their taxes. Judgment liens are created when a court awards a creditor with a judgment against a debtor, allowing the creditor to place a lien on the debtor's property. Bankruptcy liens are established when an individual or business files for bankruptcy, and all of their assets become subject to the control of the bankruptcy court.

Scope of General Liens

General liens have a broad scope, extending to all assets of the debtor. This means that the lienholder has the right to seize and sell any property owned by the debtor, regardless of its type or value. The scope of general liens provides a significant advantage to creditors since they have the potential to recover their debt from any asset owned by the debtor.

Rights and Limitations of Lienholders

Lienholders who hold a general lien have certain rights and limitations. They have the right to seize and sell assets owned by the debtor to satisfy the debt. However, they must follow the legal procedures established by the jurisdiction in which the lien is enforced. Lienholders are also subject to the priority rules that determine the order in which they can claim the proceeds from the sale of the property. Additionally, lienholders may face limitations if there are other liens or claims against the same property.

Creation of General Liens

Contractual Agreements

In some cases, general liens can be created through contractual agreements. For example, a business may enter into a financing agreement with a lender that includes a general lien on all of the business's assets. This allows the lender to have a claim on all assets in the event of a default.

Non-payment or Breach of Contract

When a debtor fails to make payments or breaches a contract, a general lien can be created to secure the creditor's rights. This usually occurs when the creditor takes legal action and obtains a judgment against the debtor. The judgment can then be used to establish a general lien on the debtor's property.

Unpaid Taxes

Government authorities can create general liens on a taxpayer's property when they fail to pay their taxes. These tax liens are a powerful tool for tax collection and provide the government with the ability to recover the outstanding taxes by seizing and selling the taxpayer's property.

Judgments

General liens can be created through court judgments. When a court awards a creditor with a judgment against a debtor, the judgment can be used to establish a general lien on the debtor's property. This allows the creditor to seize and sell any assets owned by the debtor to satisfy the debt.

This image is property of images.pexels.com.

Impact of General Liens

Priority of General Liens

When multiple liens exist on a property, it is crucial to understand the priority rules that determine the order in which the liens must be satisfied. Generally, liens are satisfied in the order they were recorded, with the earlier liens taking priority over the later ones. This means that general liens established before other liens will have a higher priority and will be paid first from the proceeds of the property's sale.

Effects on the Property

General liens can have significant effects on the property subject to the lien. When a general lien exists, it can limit the debtor's ability to sell or transfer the property without first satisfying the debt. Additionally, the property may be seized and sold to satisfy the debt, resulting in the loss of ownership for the debtor.

Consequences for Debtors

For debtors, general liens can have severe repercussions. If they are unable to satisfy the debt, their property may be seized and sold, causing a significant financial loss. General liens can also impact the debtor's creditworthiness and make it more challenging to obtain financing or engage in certain transactions.

Discharge of General Liens

General liens can be discharged in several ways. The most common approach is through the payment of the debt in full. Once the debt is satisfied, the lienholder must release the lien. Another way to discharge a general lien is through a negotiated settlement with the lienholder. This can involve reaching an agreement to pay a portion of the debt in return for releasing the lien.

Legal Procedures

Foreclosure Process

When a general lien is enforced, the most common legal procedure is foreclosure. Foreclosure is the process by which the lienholder takes possession of the property and sells it to satisfy the debt. Foreclosure procedures vary depending on the jurisdiction, but they generally involve a notice period, a public sale, and the distribution of proceeds.

Sale of the Property

Once a property is seized through foreclosure, it is typically sold through a public auction or sale. The sale is conducted to maximize the proceeds and satisfy the debt. Interested parties can bid on the property, and the highest bidder will become the new owner of the property upon completion of the sale.

Distribution of Proceeds

The proceeds from the sale of the property are distributed according to the priority rules established by the jurisdiction. Generally, the lienholder with the highest priority will receive their share of the proceeds first, followed by the lower-priority lienholders. If there are any remaining funds after all liens are satisfied, they will be given to the debtor.

This image is property of images.pexels.com.

Negotiating General Liens

Working with Lienholders

When faced with a general lien, it is important to establish open communication with the lienholder. By working with the lienholder, individuals and businesses may be able to negotiate a repayment plan or settlement that satisfies the debt and results in the release of the lien.

Negotiating Lien Releases

One possible approach to resolving a general lien is to negotiate a lien release with the lienholder. This involves reaching an agreement to pay a portion of the debt in exchange for the release of the lien. Negotiating lien releases can be complex and may require the assistance of legal professionals or financial advisors.

Settlement Options

Another option for resolving general liens is through a settlement agreement. In a settlement agreement, the debtor and the lienholder agree to a specific sum of money or alternative arrangement to resolve the debt. Settlement options can vary depending on the circumstances and the willingness of both parties to reach a mutually beneficial agreement.

Legal Assistance for Resolving General Liens

Resolving general liens can be a complex legal process. In cases where negotiations are unsuccessful, it may be necessary to seek legal assistance. An experienced attorney can provide guidance and representation to help navigate the legal procedures and protect the debtor's rights.

Protecting Against General Liens

Awareness of Potential Liens

To protect against general liens, individuals and businesses should maintain awareness of any potential liens that could arise. This includes staying up to date on tax obligations, contractual agreements, and any other financial arrangements that could result in the creation of liens.

Maintaining Accurate Financial Records

Accurate financial records are essential in protecting against general liens. By keeping detailed records of financial transactions, contracts, and debts, individuals and businesses can demonstrate their payment history and fulfill their obligations, reducing the likelihood of general liens being imposed.

Timely Payment of Debts

One of the most effective ways to protect against general liens is to ensure timely payment of debts. By paying bills, loans, and taxes promptly, individuals and businesses can avoid defaults and the creation of liens on their properties.

Insurance Coverage for Certain Debts

In some cases, insurance coverage can provide a layer of protection against certain types of debts. For example, title insurance can protect against title defects and unexpected liens on real estate properties. Individuals and businesses should explore insurance options that may mitigate the risks associated with general liens.

Seeking Legal Advice

When to Consult a Lawyer

Given the complexity and potential consequences of general liens, it is advisable to consult a lawyer when facing such situations. Lawyers specializing in debt collection, real estate, or bankruptcy can provide valuable legal advice and guidance tailored to the specific circumstances.

Determining the Best Course of Action

A lawyer can help analyze the situation and determine the best course of action when dealing with general liens. They can assess the strength of the lien, negotiate on behalf of the debtor, or devise a strategy to resolve the debt and release the lien.

Handling Disputes and Challenges

In cases where disputes or challenges arise in relation to general liens, lawyers can provide representation and guidance throughout the legal proceedings. They can help defend against wrongful or excessive liens, challenge improper foreclosure actions, or seek remedies for any damages incurred.

Navigating Complex Lien Situations

General liens can be complex and involve multiple parties and legal procedures. A lawyer can navigate these complex situations, ensuring that the debtor's rights are protected, and working towards a favorable resolution.

Conclusion

Understanding general liens is crucial for individuals and businesses alike. General liens provide significant rights and powers to creditors, allowing them to recover debts from a broad range of assets. Being aware of the different types of liens, the creation process, and the impact they can have is essential for managing one's financial obligations. By maintaining accurate records, seeking legal advice when necessary, and promptly addressing debts, individuals and businesses can protect against the potential consequences of general liens.