In the world of taxes, it's important to understand the actions that the IRS can take to enforce compliance. This article will provide you with a clear understanding of IRS enforcement actions and the potential consequences for non-compliance. From monetary fines to the possibility of an arrest warrant being issued, it's crucial to stay informed about your rights and responsibilities when it comes to taxes. So let's dive into the intricacies of IRS enforcement actions and how they can impact your financial well-being.

Understanding IRS Enforcement Actions

Overview of IRS Enforcement Actions

When it comes to federal taxes, the Internal Revenue Service (IRS) is responsible for ensuring compliance and enforcing tax laws. IRS enforcement actions refer to the various measures the IRS takes to enforce tax laws and hold taxpayers accountable. These actions can range from tax audits to criminal investigations, and they are designed to ensure that everyone pays their fair share of taxes and to deter tax evasion and fraud.

Types of IRS Enforcement Actions

There are several types of IRS enforcement actions that the agency can initiate depending on the severity and nature of the non-compliance. These actions include tax audits, criminal investigations, tax levy and seizure, penalties and interest assessments, and civil lawsuits. Each action serves a specific purpose and has its own set of procedures and consequences.

This image is property of images.unsplash.com.

The Role of IRS Criminal Investigation Division (CID)

The IRS Criminal Investigation Division (CID) plays a crucial role in investigating potential criminal violations of the tax code. CID's primary objective is to uncover and prosecute individuals and organizations engaged in illegal activities such as tax fraud, money laundering, and other financial crimes. CID agents have the authority to conduct thorough investigations, collect evidence, and collaborate with other law enforcement agencies to build strong cases against suspects.

Common Triggers for IRS Enforcement Actions

The IRS initiates enforcement actions based on certain triggers that raise red flags and indicate potential non-compliance. Some common triggers include underreporting or misreporting of income, high discrepancies and abnormalities in tax returns, offshore tax evasion, participation in tax avoidance schemes, failure to file tax returns, and employment tax violations. These triggers alert the IRS to investigate further and potentially take enforcement action.

This image is property of images.unsplash.com.

IRS Audits vs. IRS Criminal Investigations

While both IRS audits and criminal investigations are forms of enforcement actions, they differ in purpose, scope, and potential outcomes. IRS audits focus on examining tax returns for accuracy and completeness, identifying errors or discrepancies, and determining whether the taxpayer owes additional taxes or deserves a refund. On the other hand, criminal investigations are aimed at uncovering deliberate tax fraud or evasion, which may result in criminal penalties, such as fines or imprisonment.

Legal Authority of IRS Enforcement Actions

IRS enforcement actions derive their authority from the Internal Revenue Code (IRC), which outlines the tax laws and regulations enforced by the IRS. Additionally, taxpayers are protected by the Taxpayer Bill of Rights, which ensures that they have certain rights and safeguards in dealing with the IRS. It is essential for taxpayers to understand the legal framework that governs IRS enforcement actions to protect their interests and exercise their rights effectively.

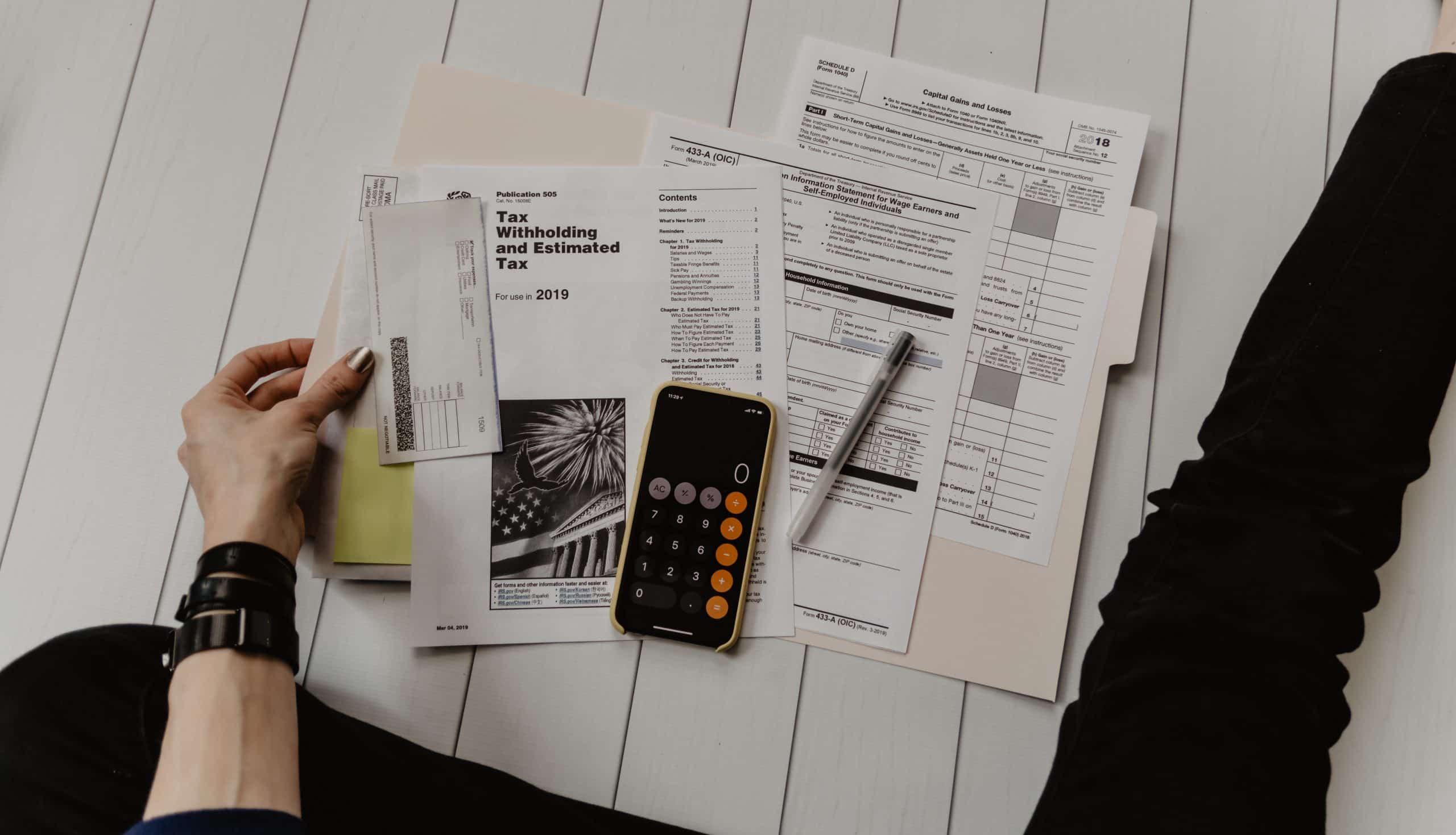

This image is property of images.unsplash.com.

Rights and Protections for Taxpayers

Taxpayers have important rights and protections when facing IRS enforcement actions. One such right is the right to representation, meaning taxpayers have the right to seek legal assistance or have a representative speak on their behalf during interactions with the IRS. Additionally, taxpayers have the right to appeal IRS decisions they believe are incorrect or unfair. The IRS is also prohibited from engaging in unlawful practices, such as harassment or unauthorized collection actions, ensuring that taxpayers are treated fairly throughout the enforcement process.

Consequences of Non-Compliance

Non-compliance with IRS regulations can have significant consequences for taxpayers. Civil penalties may be imposed for various violations, such as failure to file tax returns or underreporting income, resulting in monetary fines and interest charges. In more serious cases of intentional tax fraud or evasion, criminal penalties may be levied, including fines and potential imprisonment. Additionally, the IRS has the authority to seize and forfeit assets to satisfy outstanding tax debts. Non-compliance can also impact an individual's reputation and future financial activities, making it crucial to address IRS enforcement actions promptly and appropriately.

Challenging IRS Enforcement Actions

Taxpayers have the right to challenge IRS enforcement actions if they believe the IRS's decision is incorrect or unfair. This can involve appealing through administrative channels within the IRS or seeking external legal recourse, such as litigation. Consulting with a tax attorney or reputable tax professional can provide crucial guidance on the best approach to challenge an IRS enforcement action and protect the taxpayer's rights and interests.

Statute of Limitations for IRS Enforcement Actions

IRS enforcement actions are subject to time limitations known as the statute of limitations. The statute of limitations determines the timeframe within which the IRS can assess additional taxes, pursue collection actions, or initiate criminal proceedings. The specific limitations vary depending on the nature of the violation and can be extended under certain circumstances. Understanding the statute of limitations is crucial for taxpayers to be aware of their rights and responsibilities within a given timeframe.

In conclusion, understanding IRS enforcement actions is essential for taxpayers who want to navigate the complex world of tax compliance. By being aware of the different types of enforcement actions, knowing their rights and protections, and understanding the potential consequences of non-compliance, taxpayers can better prepare themselves to respond effectively to IRS inquiries and challenges. Seeking professional advice and guidance when facing IRS enforcement actions can be invaluable in protecting one's interests and ensuring a fair and just resolution. Remember, compliance with tax laws is a responsibility shared by all, and understanding IRS enforcement actions is a step towards fulfilling that responsibility.