In 2023, the housing market is experiencing a rebound after a slow recovery. Despite consumer confidence being low, only 18% believe it's a good time to buy a home. However, after nine consecutive months of decreasing prices in 2022, the housing prices have started to rise again, although at a slower rate. The trend of multiple offers above asking price without home preparation has also ceased. Although fixed 30-year mortgage interest rates currently sit around 7%, uncertainty surrounds the future of interest rates due to inflation, Federal Reserve policies, and recession fears. If you're considering buying a home, it's crucial to evaluate your personal readiness and financial situation, taking into account factors such as the length of time you plan to stay in the home, the down payment you can make, your credit score, and your budget. Buyers with lower down payments and credit scores may explore options such as FHA loans, VA loans, and USDA loans. It's important to remember that the average mortgage payment in America is $2,605, and additional expenses like taxes, insurance, HOA fees, and mortgage insurance should be factored into the decision as well. Lastly, it's essential to consider the affordability of housing in your desired location, as rising prices and limited affordable options might make it less favorable to buy a home in certain areas.

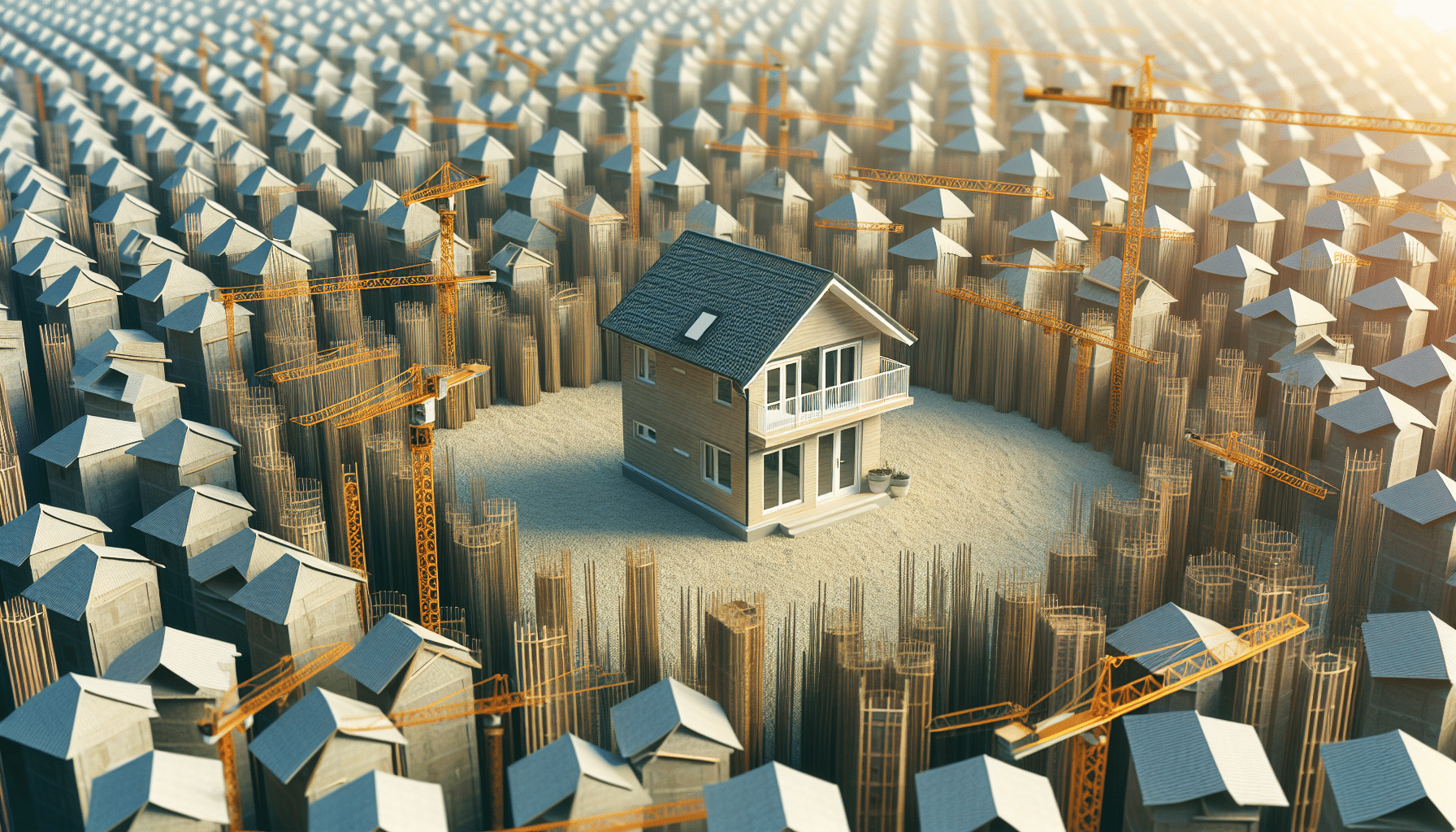

Housing Prices Rebound in 2023 Amidst Slow Recovery

After experiencing a prolonged period of decline, housing prices have finally started to rebound in 2023, although at a slower rate. This positive trend indicates a slow recovery for the housing market, offering some hope for both buyers and sellers. However, it is important to consider various factors before making the decision to buy a home.

This image is property of images.pexels.com.

Consumer Confidence in Buying Homes

Consumer confidence in the housing market is currently low, with only 18% of people believing that it's a good time to buy a home. This lack of confidence can be attributed to the recent decrease in housing prices and the uncertain economic climate. Potential buyers may be hesitant to enter the market due to fears of further decline in housing prices or an impending recession.

Trend of Multiple Offers Above Asking Price

Although housing prices have begun to rebound, sellers' expectations have been slow to adjust. As a result, there was a trend of multiple offers above the asking price in the past. However, this trend has now halted, indicating a more balanced market. Sellers must now focus on preparing their homes for sale and ensuring that they are attractive to potential buyers.

Fixed 30-year Mortgage Interest Rates

One factor that potential homebuyers need to consider is the current fixed 30-year mortgage interest rates, which are currently high at around 7%. These high rates can have a significant impact on the affordability of homes and may deter some buyers from entering the market. It is important to carefully evaluate the long-term financial implications of a high-interest rate mortgage before making a purchase.

Uncertain Future of Interest Rates

The future of interest rates remains uncertain and is influenced by various factors. Inflation, Federal Reserve policies, and fears of a recession all play a role in determining the direction of interest rates. It is essential for potential buyers to closely monitor these factors and seek guidance from financial professionals to make informed decisions regarding their home purchase.

This image is property of images.pexels.com.

Factors to Consider Before Buying a Home

Before making the decision to buy a home, there are several important factors that you should consider. Firstly, evaluate your personal readiness for homeownership, including your stability in terms of career and personal life. Additionally, assess your financial situation to determine if buying a home aligns with your current and future financial goals. Consider the length of time you expect to stay in the home, as this can impact the financial feasibility of your purchase. Furthermore, take into account your down payment amount, credit score, and overall budget to ensure that you can afford the associated costs of homeownership.

Options for Buyers with Lower Down Payments and Credit Scores

For buyers with lower down payments and credit scores, there are options available to help facilitate homeownership. FHA loans, VA loans, and USDA loans are all viable options that provide more flexible eligibility requirements and lower down payment thresholds. These loan programs can offer a path to homeownership for individuals who may not meet the traditional requirements of conventional mortgage loans.

This image is property of images.pexels.com.

Average Mortgage Payment in America

The average mortgage payment in America is currently $2,605 per month. However, it is important to note that this amount may vary depending on factors such as the size of the mortgage, the interest rate, and the length of the loan. In addition to the mortgage payment, buyers should also consider other fees associated with homeownership, such as property taxes, homeowners insurance, HOA fees (if applicable), and mortgage insurance.

Affordability Variances Based on Location

Affordability in the housing market can vary significantly depending on the location. In some areas, rising housing prices may make it more challenging for buyers to enter the market or find affordable options. Limited affordable housing options can further exacerbate this issue, making it necessary for buyers to carefully assess the local market conditions before deciding to purchase a home. Considerations such as job opportunities, cost of living, and future growth prospects should be taken into account to ensure that buying a home in a particular location is a financially sound decision.

In conclusion, the housing market has shown signs of rebounding in 2023, but the recovery remains slow. Consumer confidence in buying homes is low, and sellers' expectations have been slow to adjust. Fixed 30-year mortgage interest rates are currently high, and the future of interest rates is uncertain. It is important for potential buyers to carefully evaluate their personal readiness, financial situation, and various factors before buying a home. Options exist for buyers with lower down payments and credit scores, but it is crucial to consider the affordability variances based on location. By taking these factors into account, individuals can make informed decisions regarding their home purchase and navigate the housing market with confidence.