So, you've gone through the process of filing for bankruptcy, hoping for a fresh start from overwhelming debt. But what happens when your bankruptcy case is dismissed? Don't worry, you're not alone in this situation. In this article, we will explore what you can do when bankruptcy is dismissed and guide you on the next steps to take. Whether it's understanding the reasons behind the dismissal or exploring alternative debt relief solutions, we've got you covered. Let's dive in and find a way to overcome this setback together.

Understanding Bankruptcy Dismissal

Definition of bankruptcy dismissal

Bankruptcy dismissal refers to the termination or cancellation of a bankruptcy case by the court before the debtor receives a discharge of their debts. When a bankruptcy case is dismissed, it means that the debtor's financial obligations are not discharged, and they are no longer protected by the automatic stay, which halts collection actions from creditors.

Reasons for bankruptcy dismissal

There are several reasons why a bankruptcy case may be dismissed:

-

Failure to complete mandatory requirements: If you fail to fulfill certain requirements, such as attending credit counseling sessions or submitting necessary documents, the court may dismiss your bankruptcy case.

-

Non-payment of fees: You are required to pay certain fees in a bankruptcy case. If you fail to make these payments as required, the court may dismiss your case.

-

Fraudulent or abusive behavior: If the court determines that you have engaged in fraudulent activities, such as hiding assets or providing false information, your bankruptcy case may be dismissed. Similarly, if you abuse the bankruptcy system by filing multiple bankruptcy cases within a short period, the court may dismiss your case.

Implications of bankruptcy dismissal

The dismissal of a bankruptcy case has significant implications for the debtor. Some of the key implications include:

-

Loss of automatic stay: The automatic stay, which provides protection from creditors and collection actions, is lifted upon dismissal. Creditors can resume their collection efforts, including foreclosure and repossession proceedings.

-

Debts remain unchanged: Unlike a discharge in bankruptcy, where debts are eliminated or restructured, a dismissal leaves the debtor responsible for all outstanding debts. Creditors can continue pursuing legal remedies to collect what they are owed.

-

Credit score impact: Bankruptcy dismissal can have a negative impact on your credit score, making it more challenging to secure loans or credit cards in the future. It is important to address the underlying financial issues promptly.

Taking Immediate Action

Evaluate the reasons for dismissal

Upon learning of the dismissal, it is crucial to evaluate the reasons behind it. Understanding why your bankruptcy case was dismissed will help you address the underlying issues effectively. Review the court's order of dismissal and identify any specific requirements or actions that you failed to complete.

Consult with an attorney

Seeking legal advice from a knowledgeable bankruptcy attorney is essential after your case is dismissed. An attorney can help you navigate the complex legal process, explain your options, and guide you towards the best course of action. They will assess the circumstances surrounding your dismissal and provide personalized recommendations.

Identify alternative debt relief options

While bankruptcy may have seemed like the optimal solution, its dismissal presents an opportunity to explore alternative debt relief options. These options may include debt settlement, debt consolidation, or negotiating with creditors directly. A debt relief professional or credit counselor can assist you in determining the most suitable course of action based on your financial situation.

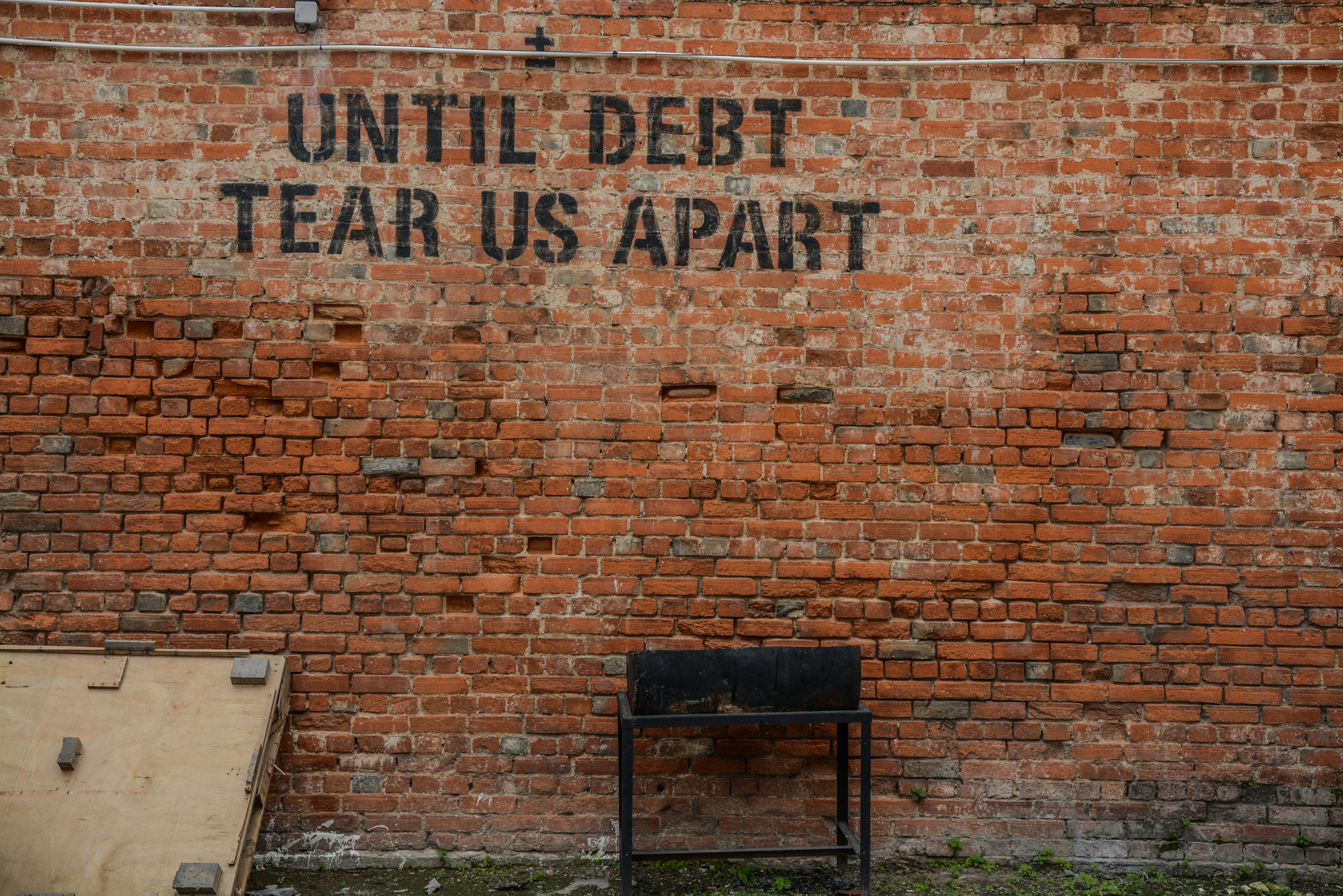

This image is property of images.unsplash.com.

Addressing the Underlying Issues

Review and analyze your financial situation

To avoid a repeat of the dismissal, it is crucial to conduct a thorough review and analysis of your financial situation. Review your income, expenses, and debts to understand the root causes of your financial difficulties. Identify areas where you can make improvements or adjustments to achieve financial stability.

Create a realistic budget

Creating a realistic budget is a vital step in regaining control of your finances. Start by listing all your sources of income and your essential expenses, such as housing, utilities, and groceries. Allocate a portion of your income towards debt repayment, while also allowing for savings and emergency funds. Be diligent in tracking your expenses to ensure you stay within your budget.

Cut expenses and increase income

To address your financial challenges effectively, it may be necessary to reduce unnecessary expenses and increase your income. Look for areas where you can cut back on discretionary spending and find ways to save money. Consider taking on part-time work or exploring additional sources of income to supplement your primary earnings. Each small adjustment can contribute to improving your financial situation over time.

Revisiting Bankruptcy

Determine the feasibility of filing for bankruptcy again

After experiencing a dismissal, it is essential to reassess the feasibility of filing for bankruptcy again. Consider the reasons for the dismissal and evaluate whether those issues can be overcome in a subsequent bankruptcy case.

Identify the right type of bankruptcy for your situation

If it is determined that filing for bankruptcy is still the most viable option, it is crucial to identify the appropriate type of bankruptcy for your situation. Chapter 7 and Chapter 13 bankruptcies provide different benefits depending on your income, assets, and debt load. Discussing your circumstances with a bankruptcy attorney can help you determine the most suitable path forward.

Gather and organize required documentation

To ensure a smooth bankruptcy filing process, gather and organize all the necessary documentation. This may include income records, tax returns, bank statements, and a list of your assets and debts. Having these documents readily available will help streamline the process and avoid delays or potential dismissal.

This image is property of images.unsplash.com.

Exploring Debt Repayment Plans

Consider debt settlement

Debt settlement involves negotiating with creditors to settle your debts for less than what you owe. This option can be an alternative to bankruptcy and may allow you to repay a portion of your debts over a specified period. It is essential to work with a reputable debt settlement company or credit counselor who can negotiate effectively on your behalf.

Negotiate with creditors

Open communication with your creditors is essential when seeking debt relief. Contact them to discuss your financial situation and explore potential options, such as loan modifications, deferred payments, or reduced interest rates. Creditors may be willing to work with you to establish a revised repayment plan that better aligns with your current financial capabilities.

Enroll in a debt management program

A debt management program (DMP) is an option that allows you to consolidate your debts into one monthly payment. Through a credit counseling agency, you can enroll in a DMP that offers reduced interest rates and a structured repayment plan. Working with a credit counselor will help you develop a personalized plan to manage and pay off your debts.

Seeking Credit Counseling

Find a reputable credit counseling agency

When dealing with financial difficulties, seeking help from a reputable credit counseling agency can provide valuable guidance. Research and find a credit counseling agency that is accredited and has a track record of assisting individuals in similar situations. Avoid agencies that charge excessive fees or make unrealistic promises.

Understand the benefits of credit counseling

Credit counseling offers several benefits to individuals facing financial hardship. These include budgeting assistance, debt management strategies, financial education, and guidance on rebuilding credit. Credit counselors can work with you to create a comprehensive plan that addresses your unique financial needs and goals.

Follow the recommended financial management strategies

During credit counseling, you will receive customized recommendations and strategies to effectively manage your finances. It is crucial to implement these recommendations and follow the provided guidance. This may involve adjusting your spending habits, implementing a debt repayment plan, or learning new financial skills. Consistency and commitment to these strategies will contribute to your long-term financial well-being.

This image is property of images.unsplash.com.

Protecting Your Assets

Review and understand exempt property laws

Before taking any action to protect your assets, it is crucial to review and understand the exempt property laws in your jurisdiction. These laws define the assets that are protected from creditor collection efforts in a bankruptcy case. By knowing the exemptions available to you, you can make informed decisions to safeguard your assets.

Implement asset protection strategies

Certain asset protection strategies can help safeguard your property in the face of financial difficulties. This may include transferring assets to an irrevocable trust, homestead exemptions, or adjusting your property ownership structure. Implementing these strategies requires careful consideration and should be done under the guidance of a knowledgeable bankruptcy attorney.

Consider consulting with a bankruptcy attorney

Given the complexity of bankruptcy laws and asset protection strategies, it is advisable to consult with a bankruptcy attorney. They can assess your unique situation, advise you on potential asset protection measures, and assist you in implementing the appropriate strategies. Seeking professional advice will help ensure that your assets are protected to the fullest extent possible.

Staying Committed to Financial Recovery

Stay organized with your financial records

Maintaining organized financial records is crucial for effective financial management. Keep track of your income, expenses, bills, and debt repayment efforts. Maintain copies of important documents, such as tax returns, bank statements, and legal agreements. By staying organized, you can easily reference information when needed and make informed financial decisions.

Continue budgeting and tracking expenses

Even after taking steps to address your financial difficulties, it is essential to continue budgeting and tracking expenses. Regularly review your budget and make adjustments as necessary. Tracking your expenses allows you to identify potential areas of improvement and ensure that you are keeping within your financial means.

Seek ongoing financial education

Continuous learning about personal finance and financial management is crucial for long-term financial recovery. Take advantage of educational resources, workshops, and online courses to enhance your financial knowledge. By staying informed, you can make better financial decisions, improve your financial habits, and avoid future financial pitfalls.

Rebuilding Your Credit

Check your credit reports regularly

To rebuild your credit, it is important to regularly check your credit reports for accuracy. Obtain free copies of your credit reports from the major credit bureaus and review them for any errors or inaccuracies. Disputing and correcting any incorrect information will help improve your creditworthiness.

Dispute any inaccuracies on your credit report

If you identify any inaccuracies on your credit report, take immediate steps to dispute them. Contact the credit reporting agencies in writing, provide supporting documentation, and request that the errors be corrected. A clean and accurate credit report is essential for rebuilding your credit.

Gradually rebuild your credit history

Rebuilding your credit takes time and patience. Make consistent, on-time payments on any remaining debts. Consider opening a secured credit card or obtaining a small installment loan to demonstrate responsible credit usage. By utilizing credit responsibly and maintaining a positive payment history, you can gradually rebuild your credit score.

Maintaining Emotional Well-being

Seek emotional support from loved ones

Dealing with financial difficulties can take an emotional toll. Seek emotional support from your loved ones, such as family or close friends. Openly communicate about your situation and share your feelings. Having a support network can provide comfort, motivation, and a safe space to discuss any challenges or concerns.

Manage stress and anxiety related to financial difficulties

Financial difficulties can increase stress and anxiety levels. Practice stress management techniques such as meditation, exercise, or engaging in hobbies that bring you joy. Consider seeking professional help, such as therapy or counseling, to address any emotional distress caused by your financial situation.

Focus on self-care and maintain a positive mindset

Amidst financial difficulties, it is important to prioritize self-care and maintain a positive mindset. Take time for activities that bring you joy and relaxation. Set realistic goals and celebrate small victories along the way. Adopting a positive mindset will not only help you navigate your financial recovery but also contribute to your overall well-being.

In conclusion, experiencing a bankruptcy dismissal can be overwhelming, but it does not mean the end of the road for regaining control of your financial situation. By taking immediate action, addressing the underlying issues, exploring alternative debt relief options, seeking credit counseling, protecting your assets, staying committed to financial recovery, rebuilding your credit, and maintaining emotional well-being, you can embark on a path towards financial stability and a brighter future. Remember, with determination and the right support, you can overcome the setbacks and successfully navigate your journey to financial recovery.